If you do not have a permanent account number (PAN), you can now get the Instant e-PAN from the income tax department. E-PAN is a digitally signed PAN card issued by the I-T Department in electronic format.

Eligibility for e-PAN

E-PAN card can be applied for only by Indian residents other than minors and people covered under Section 160 of the Income Tax Act. Hence, the e-PAN card cannot be obtained by Hindu Undivided Families, firms, trusts, companies etc. e-Pan is created based on the details entered in the Aadhar Card. Hence, only persons holding Aadhar can obtain e-PAN and if the details in the Aadhar Card are incorrect, the e-PAN will also be incorrect. Hence, in case of correction, the applicant can visit the official website of UIDAI to correct Aadhaar details before applying for e-PAN card.

How to Get instant free e-PAN card Through Aadhaar

Finance Minister Nirmala Sitharaman launches to get instant PAN card facilities through Aadhaar. Now, people can apply for instant PAN with Aadhaar based e-KYC. The facility is available for all those people who have a valid Aadhaar number and have a mobile number registered on it. PAN is issued in a PDF format to applicants, which is free of cost. The facility of instant PAN through Aadhaar is available on the income tax e-filing website.

Individuals who already have a PAN can not apply for an e-Pan. Furthermore, ePAN can not be acquired by a company or LLP or a partnership company.

key points to be known before applying for an e-pan card

- For an instant PAN card, applicants who have an Aadhaar number from UIDAI and also have registered their mobile number with Aadhaar, can apply for this only i.e – The applicant should have registered his mobile number with Aadhaar.

- E-PAN is a digitally signed PAN card issued by the Income Tax Department in electronic format.

- e-PAN is not different from the PAN issued by the Income Tax Department via other modes of application.

- This is a paperless procedure and applicants are not required to submit or upload any documents.

- Your complete date of birth in (DD-MM-YYYY) format is available on Aadhaar card.

- The applicant should not have another PAN. Possession of more than one PAN will result in a penalty of Rs 10,000 under section 272B(1) of the Income-tax Act.

Instant PAN applicants are required to access the Income Tax Department’s e-filing website to provide their valid Aadhaar number and then submit the received OTP to their registered Aadhaar mobile number.

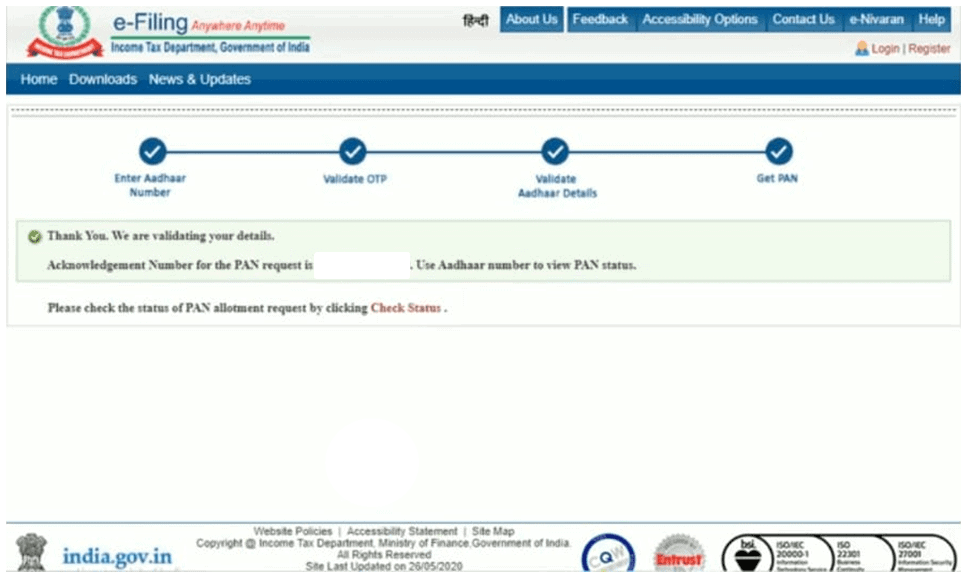

A 15-digit acknowledgment number is generated upon successful completion of this process. If required, the applicant can check the status of the request anytime by providing valid Aadhaar number and on the successful allotment, you can download the e-PAN from the provided link

Procedure to Apply for an Instant e-PAN card

Now you can apply for you pan card by your own. Here is very simple process by which anyone can apply for it. The following process have to be followed to apply for an e-Pan card:

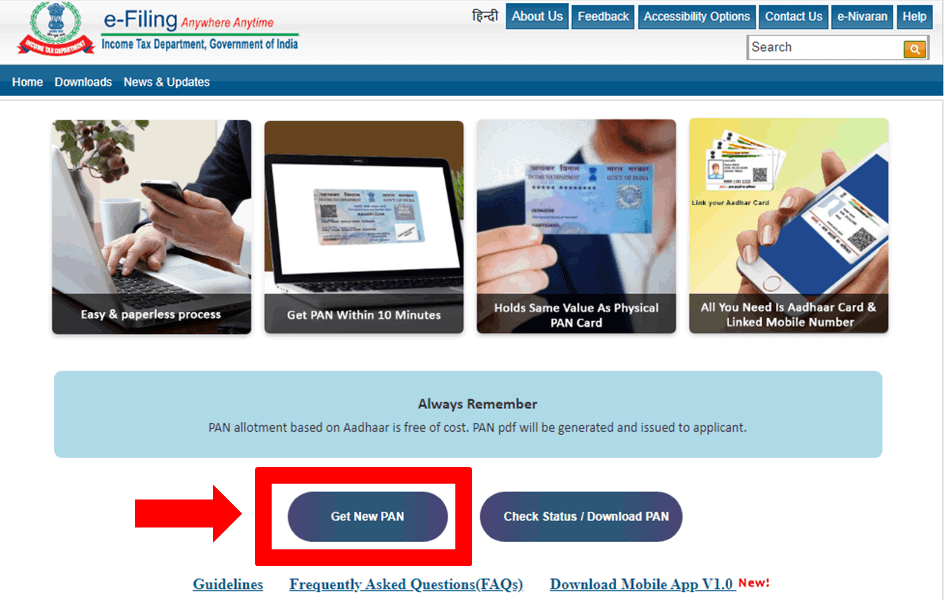

Step1: Visit e-filing website of the Income Tax www.incometaxindiaefiling.gov.in.

Step 2: Cick on “Instant PAN through Aadhaar“

Step 3: Click on the “Get New PAN” option

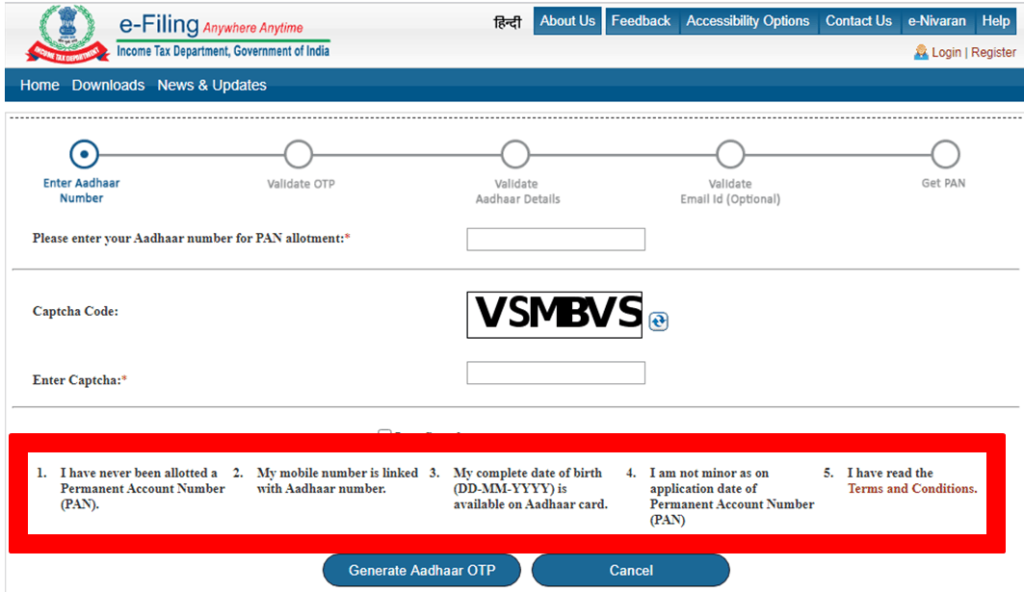

Step 4: Now Enter your Aadhaar number, captcha code, and confirm , You will be required tick that box to confirm.

*Read all these points before Generating Aadhaar OTP.

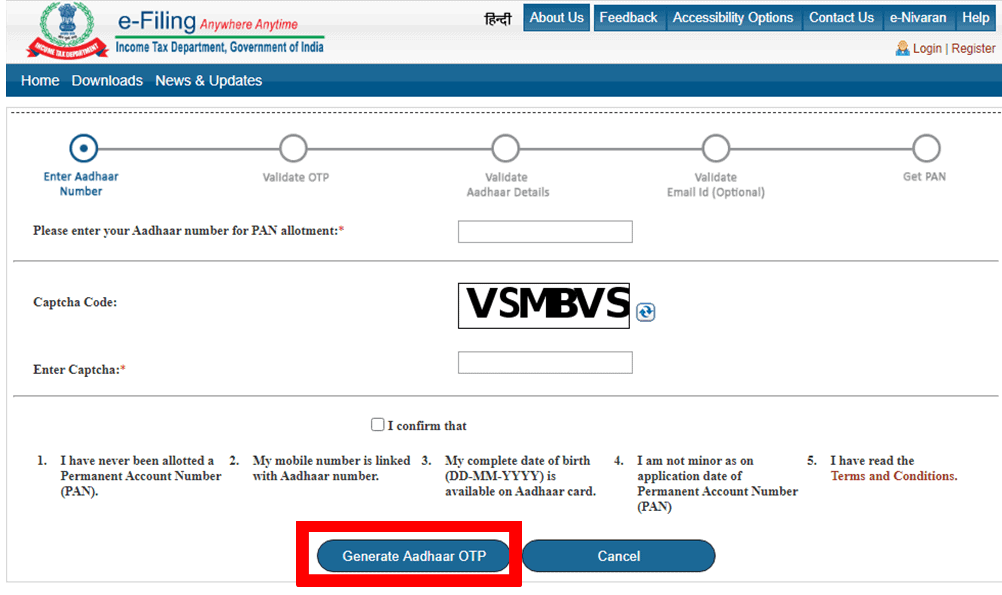

Step 5: Now click on “generate Aadhaar OTP“. A one-time password (OTP) will be sent on your registered mobile number with Aadhaar

Step 6: Enter an OTP and click on validate “Aadhaar OTP and Continue”

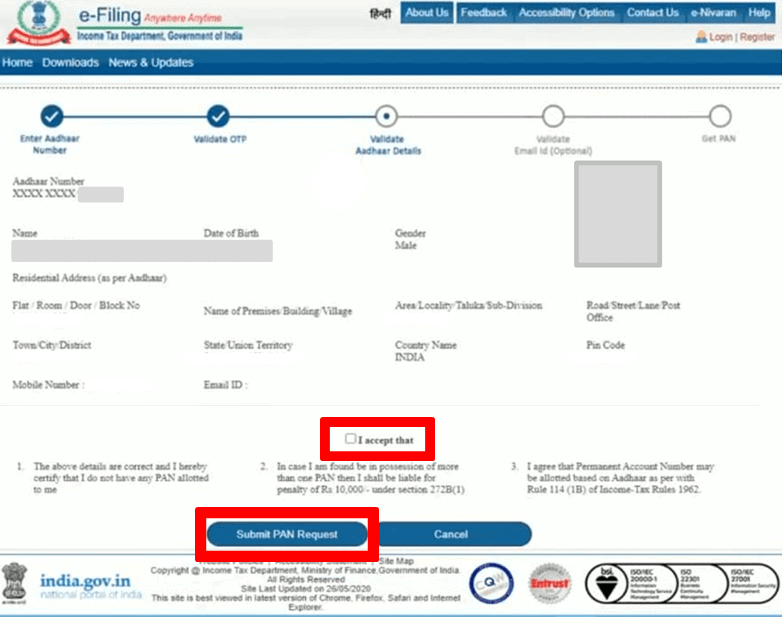

Step 7: Check the name, date of birth and all other details shown are correct and then tik on “I accept that” and proceed to “submit PAN request”

Step 8: Once the details are submitted successfully, an 15 digit acknowledgement number will be generated.

Step 9: After that you can Check the status of e-PAN to know whether e-Pan has been allotted or not

Step 10: And If it is allotted, you can download e-PAN card in pdf format.

How to download or check status of e-PAN card

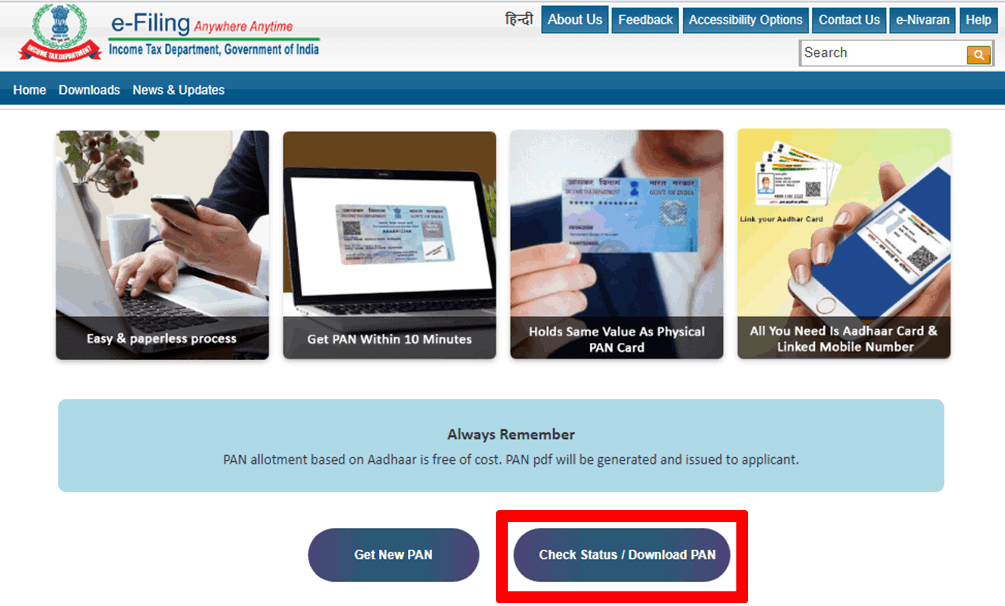

- To download or check the status of e-PAN, You need to visit e-Filing website of the Income-tax Department. i.e. https://www.incometaxindiaefiling.gov.in

- And Click on the “Instant PAN through Aadhaar“.

- Then click on the “Check Status / Download PAN“.

- Then Submit the Aadhaar number and enter the correct Captcha code then click on submit.

- Now enter the OTP sent to the mobile number which is registered with Aadhaar.

- Check the status of the application whether or not PAN is alloted.

- If PAN is alloted, then click on the download link to get a copy of the e-PAN PDF file.

Note: pan card pdf file is password protected. To open the file use your date of birth for password in the format DDMMYYYY. For e.g your date of birth is 15-04-1991, then the password is 15041991.

Frequently Asked Questions (FAQs) for Allotment of Instant PAN based on Aadhaar

Q1: What is Aadhaar based Instant PAN?

Answer: Aadhaar-based instant PAN allotment service is to provide PAN in near-real time. You are required to quote a valid Aadhaar number issued by India’s Unique Identification Authority (UIDAI) and not linked to any PAN. The e-KYC data from that Aadhaar number will be exchanged with India’s Unique Identification Authority (UIDAI). You will receive a PAN after due processing of e KYC data in the Income Tax Database.

Q2: Is this PAN valid? Is it different from the PAN issued by other modes of application?

Answer: Yes, this PAN is valid. It is not different from the PAN issued by the Income Tax Department through other means of application. However, this PAN is paperless, online and free of charge.

Q3: If I apply for Instant PAN, how am I going to get the allotted PAN?

Answer: You can download your PAN by submitting the Aadhaar number at Check Status of PAN. You will also receive the PAN in PDF format by e-mail, if your e-mail ID is registered with Aadhaar.

Q4: Do I have to pay for using this facility of Aadhaar based Instant PAN?

Answer: No, This facility is free of charge.

Q5: What is e-PAN card?

Answer: E-PAN is a digitally signed PAN card issued in electronic format by the Income tax department.

Q6: Is e-PAN a valid form of PAN?

Answer: Yes, e-PAN is a valid PAN proof. e-PAN contains a QR code with demographic details of the applicant for PAN, such as name , date of birth and photograph. These details can be accessed through a QR code reader. E-PAN is duly recognized by Notification No. 7 of 2018 dated 27.12.2018, issued by the Chief Director General of Income-Tax (Systems).

Q7: What if I do not get an OTP?

Answer: You can resubmit your Aadhaar e-KYC page to get a new OTP. If you don’t get an OTP yet, you need to contact UIDAI.

Q8: Can I apply for PAN if my Aadhaar Card is not active?

Answer: No, you cannot apply.

Q9: Will I get a physical PAN card?

Answer: No. You will be issued an e-PAN which is a valid form of PAN.

You can read our other blogs.

Stimulus Checks 2024 [4th Stimulus Check Release Date]

Stimulus Checks 2024 yet to be release. Know will this year see IRS Stimulus Checks or Not? Note: The information is updated according to November 2023. Stimulus Checks 2024 Many Americans are looking forward to hearing…

Continue Reading Stimulus Checks 2024 [4th Stimulus Check Release Date]

business profession code – Business / Profession Code under MCA

In India, the Business/Profession Code is a classification system used to categorize various business and professional activities for the purpose of registering a company with the Ministry of Corporate Affairs (MCA) and determining regulatory compliance requirements…

Continue Reading business profession code – Business / Profession Code under MCA

GST Full Form [What is The Full Form of GST]

GST Full Form: Goods and Services Tax. GST is a value-added tax system introduced in India on July 1st, 2017, which replaces various indirect taxes previously levied on goods and services. The primary objective of GST…

Continue Reading GST Full Form [What is The Full Form of GST]

Full Form Of Tally [Meaning, Importance & Usage]

Account or auditor are well known from the term Tally. But a student who wants to career in accounting, have familiar with the meaning, importance, usage, and full form of Tally. As we all know, in…

Continue Reading Full Form Of Tally [Meaning, Importance & Usage]

Contact Us

If any queries/doubt, feel free to contact us at caadagarwal@gmail.com

You may refer our channel on Youtube also:CA ADAgarwal

Kindly “Subscribe” our channel on YouTube for regular updates on Income Tax & GST.

Disclaimer – Author has exercised utmost care while writing this article, but still this article may contain some error or mistake and no part of this article/writing should be construed or considered as any advice or consultancy whether professional or otherwise. The contents of this article are solely for information and knowledge.