In a significant move towards taxpayer facilitation, the Government has today onwards allowed to File GSTR 3B NIl Return By SMS in GSTR-3B FORM. This would significantly improve the ease of GST compliance for more than 22 lakh registered taxpayers who would otherwise have to log in to their common portal account and file their returns on a monthly basis. These NIL-responsible taxpayers do not need to log in to the GST Portal and can file GST3B nil return through SMS.

NIL GSTR3B Return allowed to be filed by SMS with registered mobile number, the decision was taken by the Finance Ministry and beneficial for many registered traders across the country.

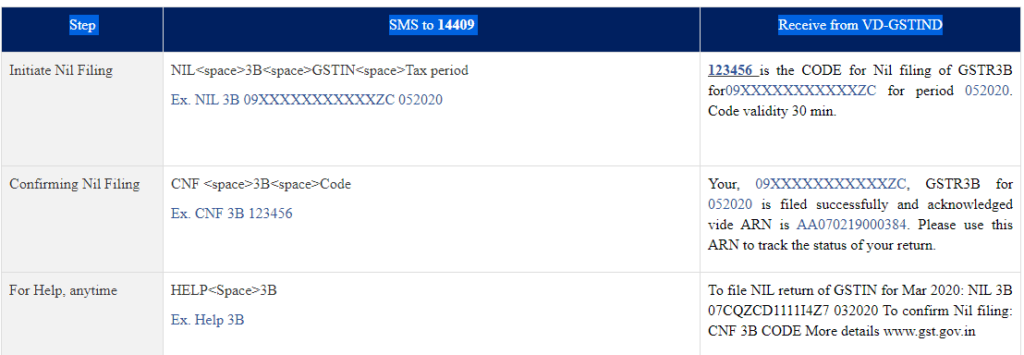

For this purpose, the functionality of filing Nil FORM GSTR-3B via SMS has been made available on the GSTN portal with immediate effect. The status of the returns filed can be tracked on the GST Portal by logging in to the GSTIN account and navigating to Services > Returns > Track Return Status. The procedure for filing Nil returns by SMS is as follows:

The government has devised a easy procedure to File GSTR 3B Nil Return with few steps.

Here is the step on, how to file GSTR 3B NIL return through SMS

- Taxpayers will need to type: NIL 3BUnique GST Identity number Tax month period (for example: NIL 3B 07XXXXXXXXXXXZ5 052020 ).

- A unique one time 6 digit password issued by the government will be sent to your registered mobile phone number. (for example: 012345 is the CODE for Nil filing of GSTR3B for 07XXXXXXXXXXXZ5 for period 052020. Code validity 30 min).

- The taxpayer will then have to type: CNF3B 6-digit unique number. (for example: Type CNF 3B 012345 and send to 14409).

Following these three basic steps, a message confirming the filing of the GST NIL returns will be sent to the mobile phone that concludes the process. (for example: Your, 07XXXXXXXXXXXZ5, GSTR3B for 052020 is filed successfully and acknowledged vide ARN is AA080114000244. Please use this ARN to track your return status.)

For any help, you can SMS HELP3B to 14409.

So, this process make it very easier for taxpayers with zero tax liability by not to log on to the GST portal and may file GSTR 3b nil returns via SMS facility, according to the government press release said.

The returns by taxpayers who owe zero taxes to the government are filed in GSTR-3B for on the portal. To download the Press Release click on the Download link.

Hope, Now you can file gst nil return with these simple steps. You can also see our other blog on Auto Populated GSTR-3B Form.

You can also subscribe to our free newsletter below to always be updated on GST and Income Tax.

Contact Us

If any queries/doubt, feel free to contact us at caadagarwal@gmail.com

You may refer our channel on Youtube also:CA ADAgarwal

Kindly “Subscribe” our channel on YouTube for regular updates on Income Tax & GST.

Disclaimer – Author has exercised utmost care while writing this article, but still this article may contain some error or mistake and no part of this article/writing should be construed or considered as any advice or consultancy whether professional or otherwise. The contents of this article are solely for information and knowledge.