Related Notifications

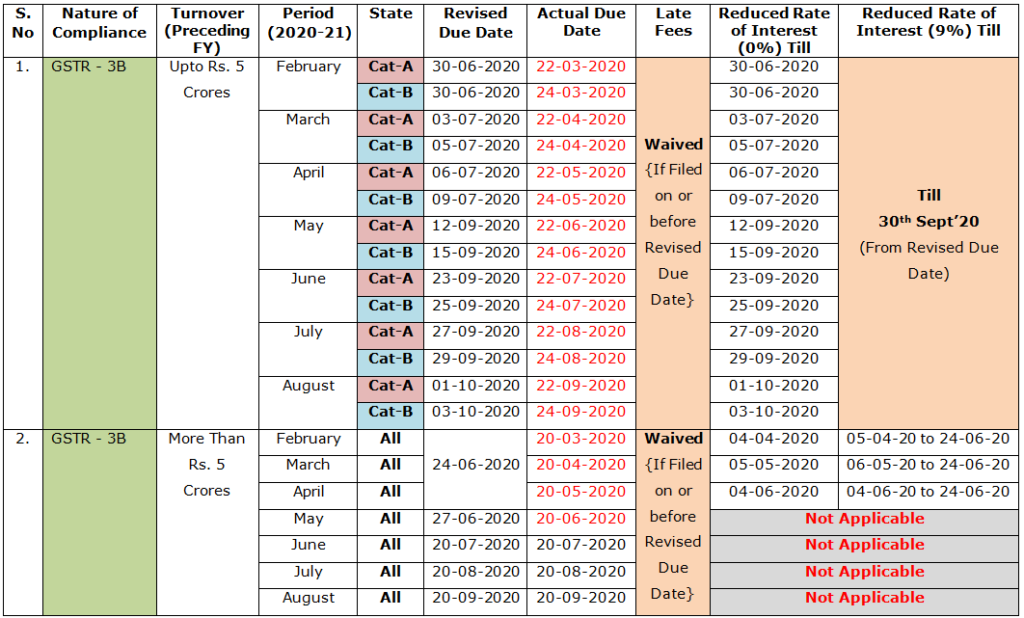

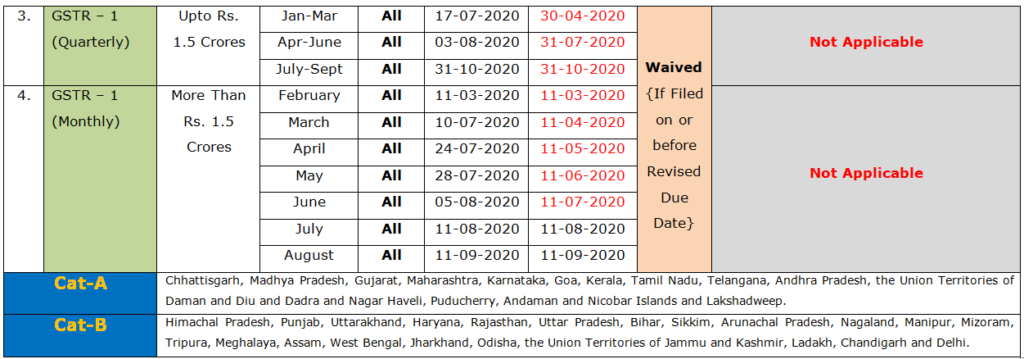

▪️ Notification No. 51/2020 – Central Tax dated 24th June, 2020

▪️ Notification No. 52/2020 – Central Tax dated 24th June, 2020

▪️ Notification No. 53/2020 – Central Tax dated 24th June, 2020

▪️ Notification No. 54/2020 – Central Tax dated 24th June, 2020

▪️ Notification No. 02/2020 – Union Territory Tax dated 24th June, 2020

▪️ Notification No. 05/2020 – Integrated Tax dated 24th June, 2020

Disclaimer – Author has exercised utmost care while writing this article, but still this article may contain some error or mistake and no part of this article/writing should be construed or considered as any advice or consultancy whether professional or otherwise. The contents of this article are solely for information and knowledge.

You can also read our other blogs.

Get free instant E-PAN card through Aadhaar in 10 minutes

If you do not have a permanent account number (PAN), you can now get the Instant e-PAN from the income tax department. E-PAN is a digitally signed PAN card issued by the I-T Department in electronic format. Eligibility for e-PAN E-PAN…

Continue Reading Get free instant E-PAN card through Aadhaar in 10 minutes

Documents Required For PAN Card for Individual & HUF

Below we have listed down required documents list to apply for PAN Card for Individual & HUF (Hindu Undivided Family). Required Documents For PAN Card Proof of IdentityProof of AddressProof of DOBAadhaar CardAadhaar CardAadhaar CardVoter ID CardVoter ID CardVoter ID CardDriving LicenseDriving…

Continue Reading Documents Required For PAN Card for Individual & HUF

Documents Required for PF and ESI Registration

The list of documents required for PF and ESI registration is given below: For Proprietorship/Individual Proprietor’s PAN card,Date of incorporation of the organization,Proprietor’s Aadhaar card,Photograph of the proprietor,GST Registration Certificate Copy,Cancelled Cheque of the Firm’s current A/c,Email Id, Mobile No. of…

Continue Reading Documents Required for PF and ESI Registration

Compliance Calendar August 2020

S.No.Nature of CompliancePeriodRevised Due DateActual Due Date1.GSTR 1 (T/o<1.5 Cr) 🔴Quarter 1 – 2020-213rd August, 202031th July, 20202.GSTR 1 (T/o>1.5 Cr) 🔴June – 2020-215th August, 202011th July, 20203.TDS/TCS DepositJuly – 2020-217th August, 20207th August, 20204.Foreign Liabilities & Assets ReturnApril – 2019-2014th…

Contact Us

If any queries/doubt, feel free to contact us at adacom26@gmail.com

You may refer our channel on Youtube also:CA ADAgarwal

Kindly “Subscribe” our channel on YouTube for regular updates on Income Tax & GST.

About the Author:

Ankit is a Chartered Accountant based in Delhi and the founder of ADA & Co. He has over 7 years of work experience, specializing in the field of taxation (Direct & Indirect) practice. He also has knowledge in the full range of financial services including Business, Taxation, Audit and Account. Further, he has managed assignments in respect of GST Audits, Bank Audits, Stock Audits, PSUs Audits, AR & AP Reconciliation etc and represented clients in tax litigative matters before Indian tax authorities. The aim of this article is to enable the professionals in the industry and students & businessmen to be aware with current developments in the Direct and Indirect tax laws and Accounting Practices.