Reset Of Email Address And Mobile Number On GST Portal

Steps to be taken by the taxpayer or user to change email id and mobile number of Authorized Signatory :-

Step-1 Login on the GST portal using your user id and password.

Step-2 Go to Services > Registration > and select Amendment of Registration Non-core Fields.

Step-3 Now Click on the Authorized Signatory tab.

Step-4 Add a new authorized signatory whose email and mobile number you want to use.

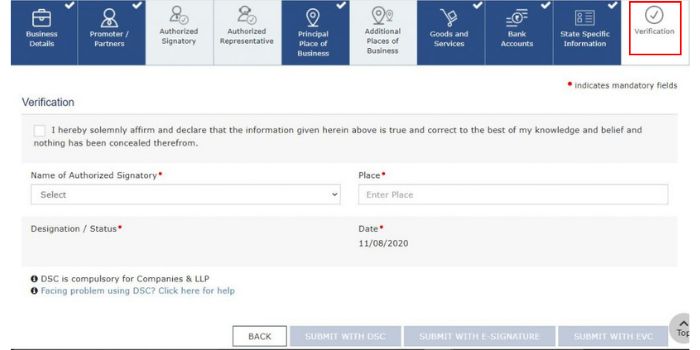

Step-5 After entering the details, go to the Verification tab and submit it.

Step-6 After successful Submission of application please wait for sometime (15-20 minutes)

Step-7 Login again on the GST Portal.

Step-8 Go to the Authorized Signatory tab – uncheck the previously Primary Authorized Signatory and select the Newly Added Authorized Signatory as a Primary Authorized Signatory.

Step-9 Go to the Verification section and Submit the application.

You will receive a confirmation message with an ARN number to track the status of the submitted application. Once a message is received by you saying ‘Changes Approved’, it means that the mobile number and email ID have been successfully updated.

In case the Primary Authorized Signatory has died or is not traceable and you want to reset the password to login into GST Portal

1. In case the Primary Authorized Signatory has died or is not traceable, you need to contact the appropriate jurisdictional Tax Officer to obtain the password to login into the GST Portal. You can know your jurisdiction from GST Registration Certificate or you can check it out by using search taxpayer tab which is available at home page of GST portal by entering your GST number.

2. You need to provide valid documents to verify, this GSTIN related to you.

3. The tax officer will check whether or not the said individual is added to the system as a Stakeholder or Authorized Signatory for that GSTIN.

4. The tax officer will upload enough proof to the GST Portal to justify the authentication of the activity.

5. The tax officer will enter your email address and your mobile number.

6. After uploading or updating all information, the tax officer will reset the GSTIN password in the system.

7. Username and Temporary password reset will be notified to your email address which is entered by the Tax Officer in your jurisdiction.

8. Now you need to login into the GST Portal via first-time login link using the Username and Temporary Password that was emailed on the updated e-mail address of the Primary Authorized Signatory. Then you will be require to change your username and password after the first-time login.

Jurisdictional Officer may add one or more Authorized Signatories for a single GSTIN, but primary Authorized Signatory can only be one.

Hope, Now you can easily Change Email Id And Mobile Number Of Authorized Signatory. If you still face any error you can contact us commenting below.

Disclaimer – Author has exercised utmost care while writing this article, but still this article may contain some error or mistake and no part of this article/writing should be construed or considered as any advice or consultancy whether professional or otherwise. The contents of this article are solely for information and knowledge.

Read Our Other Blogs Also

How to Download GST Certificate From GST Portal Online

A GST Registration Certificate in Form GST REG-06 is issued to each registered taxpayer. If you are a registered taxpayer, you may also Download GST Certificate from the GST Portal.As per the GST council, entities with an annual turnover of more than Rs.…

Continue Reading How to Download GST Certificate From GST Portal Online

GST Registration Documents Required For Proprietorship / Individual

GST Registration Documents Checklist For Proprietorship/Individual Owner’s PAN card,Owner’s Aadhaar card,Photograph of the owner,Address Proof of business:Property Tax ReceiptMunicipal Khata CopyElectricity Bill CopyWater Bill CopyLandline Bill CopyLease/Rent Agreement & Consent letter/NOC (in case of leased / rented property) For more details, you may…

Continue Reading GST Registration Documents Required For Proprietorship / Individual

Documents Required for GST Registration

Here is the list of documents required for GST registration for Sole Proprietorship or Individual, Private limited or Public limited or One person company, Partnership or LLP, HUF and Society or Trust or Club. The GST registration process is a long one which involves business-related…

Contact Us

If any queries/doubt, feel free to contact us at adacom26@gmail.com

You may refer our channel on Youtube also:CA ADAgarwal

Kindly “Subscribe” our channel on YouTube for regular updates on Income Tax & GST.

About the Author:

Mr. Ankit Agarwal is a Chartered Accountant based in Delhi and the founder of ADA & Co. He has over 7 years of post-qualification work experience, specializing in the field of taxation (Direct & Indirect) practice. He also has knowledge in the full range of financial services including Business, Taxation, Audit and Account. Further, he has managed assignments in respect of GST Audits, Bank Audits, Stock Audits, PSUs Audits, AR & AP Reconciliation etc and represented clients in tax litigative matters before Indian tax authorities. The aim of this article is to enable the professionals in the industry and students & businessmen to be aware with current developments in the Direct and Indirect tax laws and Accounting Practices.