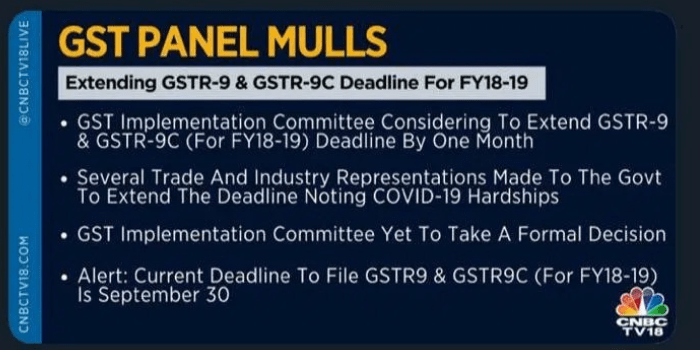

GSTR-9 and GSTR-9C The due date is expected to be extended by one month for the financial year 2018-19.

As per the CNBC-TV news alerts, there is a strong probability that the due date of GSTR-9 & GSTR-9C for the F.Y. 2018-19 can be extended by one month. The main reason for extension of due date is COVID-19.

The filing of the Annual Return in Form GSTR-9 and the Audit Certificate / Reconciliation Report in Form GSTR-9C for the financial year 2018-19 was officially required to be filed by 31st December, 2019.

As of now, the deadline of filing of the GST Annual Return and the GST Audit for 2018-19 is 30th September 2020 vide Notification No. 41/2020-Central Tax dated 5th May, 2020. But due to the continuous COVID-19 Pandemic situation, it is highly expected that the due date will be extend.

However, no official notice or notification has been yet issued regarding this, now just five days remaining.

Disclaimer – Author has exercised utmost care while writing this article, but still this article may contain some error or mistake and no part of this article/writing should be construed or considered as any advice or consultancy whether professional or otherwise. The contents of this article are solely for information and knowledge.

GST State Code List

Here we are providing the details of the GST state code list of India. The GST state code is mentioned on the GSTIN. A GSTIN or Goods and Services Tax Identification Number is a PAN-based 15-digit alphanumeric unique identification number. GSTIN is provided to…

How to File GSTR 3B Nil Return by SMS

In a significant move towards taxpayer facilitation, the Government has today onwards allowed to File GSTR 3B NIl Return By SMS in GSTR-3B FORM. This would significantly improve the ease of GST compliance for more than 22 lakh registered taxpayers who would otherwise have…

What is GSTIN and Format of GSTIN ? (15 Digit Number)

What is GSTIN Number? GSTIN stand for Goods and Service Tax Identification Number. A GSTIN is a PAN-based 15-digit unique identification number. It is allocated to every GST-registered person. This unique number is issued according to state wise. Format of gSTIN ? Format or…

Continue Reading What is GSTIN and Format of GSTIN ? (15 Digit Number)

GST Invoice Format in Excel | Word | PDF India

GST Invoice is a business instrument issued by a supplier or a seller to the recipient or the buyer of the goods and services. In other words, The GST invoice Format includes a list of goods or services provided, along with many others details…

Continue Reading GST Invoice Format in Excel | Word | PDF India

Works Contract Under GST Section 2(119)

What is a Works Contract? A work contract is a combination of service and goods movement. Example of works contract are the construction of a new building, erection, installation of plant and machinery. Defination Of Works Contract Under GST Works contracts will be treated as services,…

Partnership Authorization Letter For GST

You need to submit a Partnership Authorization letter declaring a Partner as an Authorized Signatory when registering a Partnership firm under GST. Partnership Authorization Letter Format To whomsoever it may concern Declaration for Authorised Signatory We, ________________ (Partner A) and ________________ (Partner B) of _________________…

Contact Us

If any queries/doubt, feel free to contact us at adacom26@gmail.com

You may refer our channel on Youtube also:CA ADAgarwal

Kindly “Subscribe” our channel on YouTube for regular updates on Income Tax & GST.

About the Author:

Ankit is a Chartered Accountant based in Delhi and the founder of ADA & Co. He has over 7 years of work experience, specializing in the field of taxation (Direct & Indirect) practice. He also has knowledge in the full range of financial services including Business, Taxation, Audit and Account. Further, he has managed assignments in respect of GST Audits, Bank Audits, Stock Audits, PSUs Audits, AR & AP Reconciliation etc and represented clients in tax litigative matters before Indian tax authorities. The aim of this article is to enable the professionals in the industry and students & businessmen to be aware with current developments in the Direct and Indirect tax laws and Accounting Practices.