GSTN portal has added an option to submit a refund pre-application form to get the tax refund filed by the taxpayer. The portal has provided columns in which taxpayers are required to file the tax refund by providing correct information. These columns require certain information such as:

- Aadhar Number

- Income tax paid in Financial Year 2018-2019

- Export Data

- Capital Expenditure and investment made in F.Y. 2018-2019

- Advance tax paid in F.Y. 2019-2020 (till date)

The pre-filling application help to make all the tax claim refund, simpler and easier to process, as per the applicant’s request. This ensures that the taxpayer will be able to screen the tax claim for a legitimate request and therefore make it clear to all taxpayers to apply for the tax refund as soon as possible.

To submit Refund Pre-Application Form, the Taxpayer needs to perform the following steps:

- Login in the GST Portal (www.gst.gov.in).

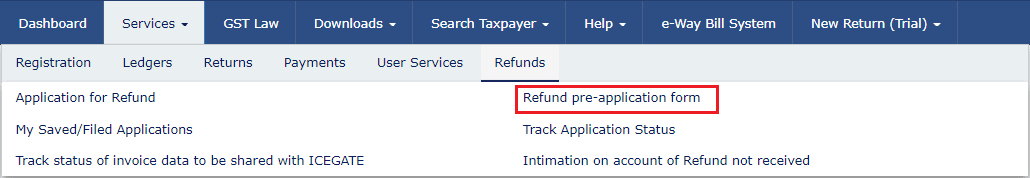

- Navigate to “Services” > “Refunds” > and then click on “Refund pre-application Form option”.

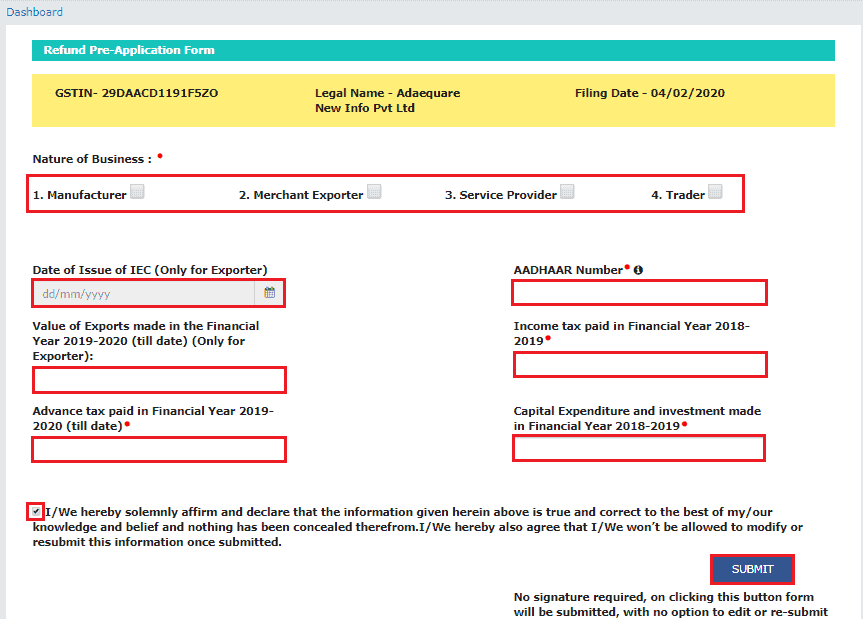

2. The Refund Pre-Application Form page will be displayed.

3. Enter the following details in the Refund Pre- Application Form such as:

- Select the Nature of Business from the given options.

- Enter the Date of Issue of IEC (Only for Exporters).

- Provide the Aadhaar Number of Primary Authorized Signatory.

- Enter the Value of Exports made in the Financial Year 2019-2020 (till date) (Only for Exporter).

- Income tax paid in Financial Year (F.Y.) 2018-2019.

- Advance tax paid in F.Y. 2019-2020 (till date).

- And Capital Expenditure and investment made in F.Y. 2018-2019.

4. Tik mark the declaration checkbox and click on the SUBMIT button.

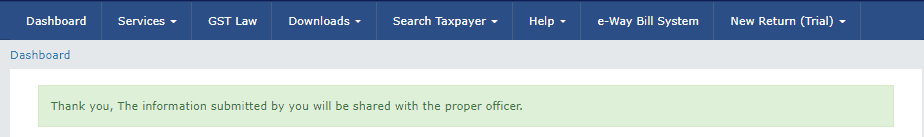

5. After that , A confirmation message of submission of the form will be displayed.

Note:

- On submitting the refund pre-application form, an acknowledgement message will be displayed on your screen. No separate e-mail or SMS will be sent to you for the same.

- Once the form is submitted, you cannot edit or re-submit the form.

Disclaimer – Author has exercised utmost care while writing this article, but still this article may contain some error or mistake and no part of this article/writing should be construed or considered as any advice or consultancy whether professional or otherwise. The contents of this article are solely for information and knowledge.

Read our Latest blogs also:-

GST State Code List

Here we are providing the details of the GST state code list of India. The GST state code is mentioned on the GSTIN. A GSTIN or Goods and Services Tax Identification Number is a PAN-based 15-digit alphanumeric unique identification number. GSTIN is provided to every…

How to File GSTR 3B Nil Return by SMS

In a significant move towards taxpayer facilitation, the Government has today onwards allowed to File GSTR 3B NIl Return By SMS in GSTR-3B FORM. This would significantly improve the ease of GST compliance for more than 22 lakh registered taxpayers who would otherwise have to…

What is GSTIN and Format of GSTIN ? (15 Digit Number)

What is GSTIN Number? GSTIN stand for Goods and Service Tax Identification Number. A GSTIN is a PAN-based 15-digit unique identification number. It is allocated to every GST-registered person. This unique number is issued according to state wise. Format of gSTIN ? Format or structure…

Continue Reading What is GSTIN and Format of GSTIN ? (15 Digit Number)

GST Invoice Format in Excel | Word | PDF India

GST Invoice is a business instrument issued by a supplier or a seller to the recipient or the buyer of the goods and services. In other words, The GST invoice Format includes a list of goods or services provided, along with many others details included…

Continue Reading GST Invoice Format in Excel | Word | PDF India

Contact Us

If any queries/doubt, feel free to contact us at adacom26@gmail.com

You may refer our channel on Youtube also:CA ADAgarwal

Kindly “Subscribe” our channel on YouTube for regular updates on Income Tax & GST.

About the Author:

Ankit is a Chartered Accountant based in Delhi and the founder of ADA & Co. He has over 7 years of work experience, specializing in the field of taxation (Direct & Indirect) practice. He also has knowledge in the full range of financial services including Business, Taxation, Audit and Account. Further, he has managed assignments in respect of GST Audits, Bank Audits, Stock Audits, PSUs Audits, AR & AP Reconciliation etc and represented clients in tax litigative matters before Indian tax authorities. The aim of this article is to enable the professionals in the industry and students & businessmen to be aware with current developments in the Direct and Indirect tax laws and Accounting Practices.