Note: In this document, the features that are currently not available in Trial version are highlighted in the Grey text for a Normal User that has selected the return filing frequency as quarterly.

To prepare your return and file Form GST RET-1:

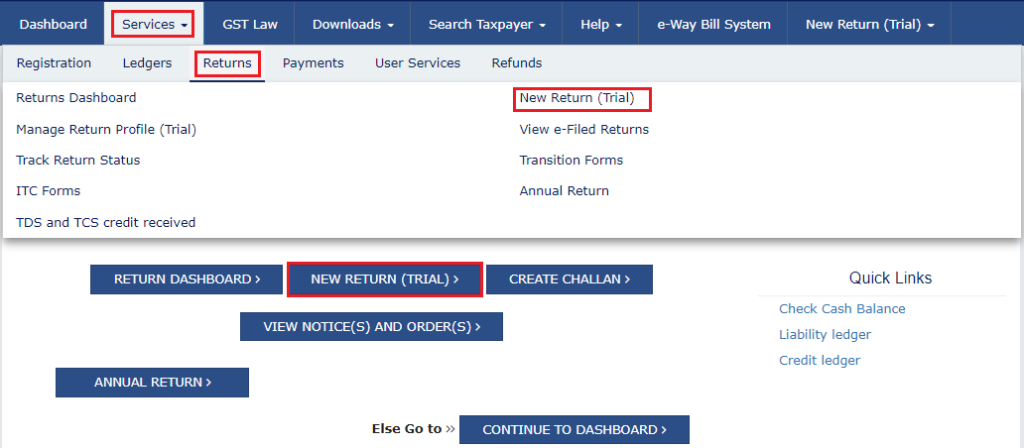

1. Login into the GST Portal and navigate to the Services > Returns > New Return (Trial). or Alternatively, click the NEW RETURN (TRIAL) button on the dashboard.

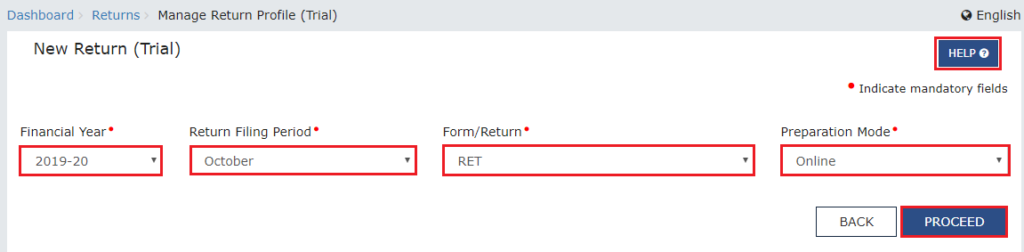

2. Select Financial Year, Return Filing Period, Form/Return (as RET-1) and Preparation Mode (as Online) from the drop-down lists and then click to PROCEED.

Note: Click on the HELP button to view the details related to this particular screen.

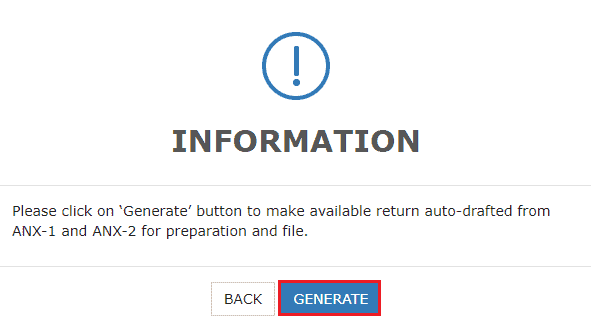

3. Click GENERATE button to make available auto-drafted return from FORM GST ANX-1 and FORM GST ANX-2 forRET-1 preparation and filing.

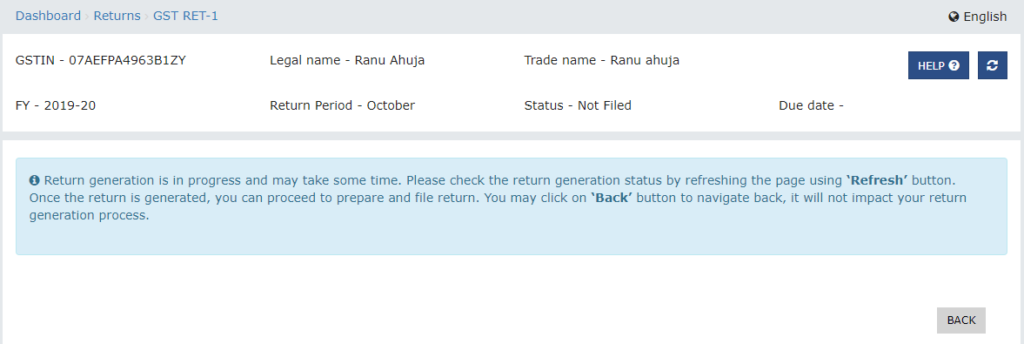

4. The message that the Return generation is in progress is shown. The process of generating a return may take some time. You can check the generation status by clicking the ‘Refresh’ button.

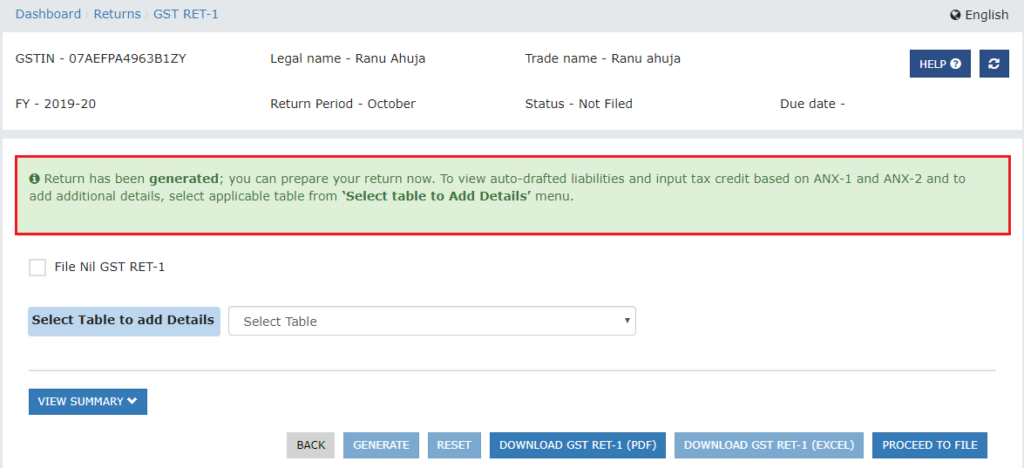

5. You will see a confirmation message that your return has been generated. You can start preparing your return after the return is generated.

5 (a). File the Nil GST RET-1 Form, if required

5 (b). File Form GST RET-1

5 (a). File the Nil GST RET-1 Form, if required

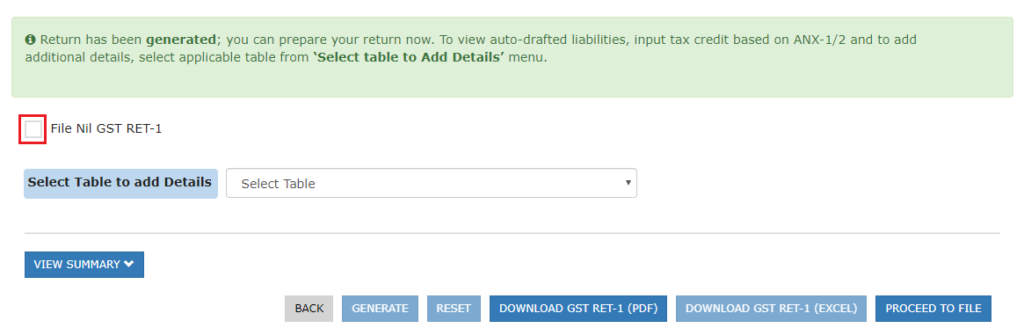

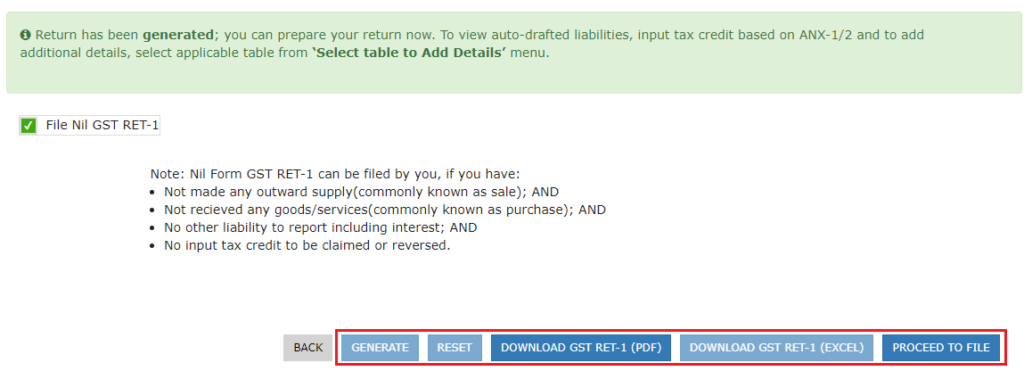

6. To file the Nil GST RET-1, select the File Nil GST RET-1 checkbox if necessary.

Note: You can file the Nil Form GST RET-1 if you have:

- No outward supply (commonly known as sale) has been made;

- No goods / services received (commonly referred to as purchases); AND

- No other liability to report including interest; AND

- There is no input tax credit to be claimed or reversed.

7. Click on the PROCEED TO FILE button.

Note:

- To regenerate a return, if some changes are made to Form GST ANX-1 and/or ANX-2, click the GENERATE button.

- To reset the user input details provided in all tables, click the RESET button.

- Click the DOWNLOAD GST RET-1 (PDF)/DOWNLOAD GST RET-1 (EXCEL) button to download the GST RET-1 summary form in PDF or Excel format.

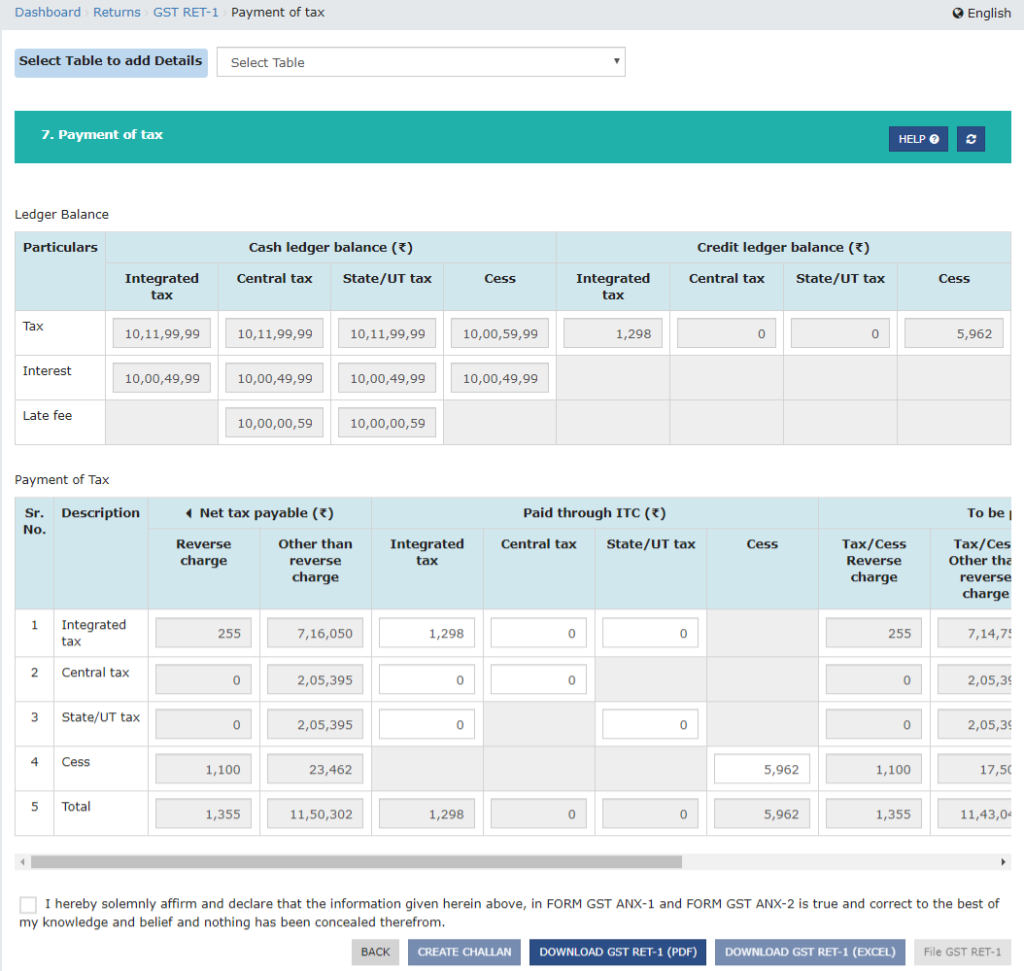

8. The RET-1 preview will be displayed. Click on the CONTINUE button.

Note: You can click the DOWNLOAD GST RET-1 (PDF)/DOWNLOAD GST RET-1 (EXCEL) button to download the GST RET-1 summary form in PDF or Excel format.

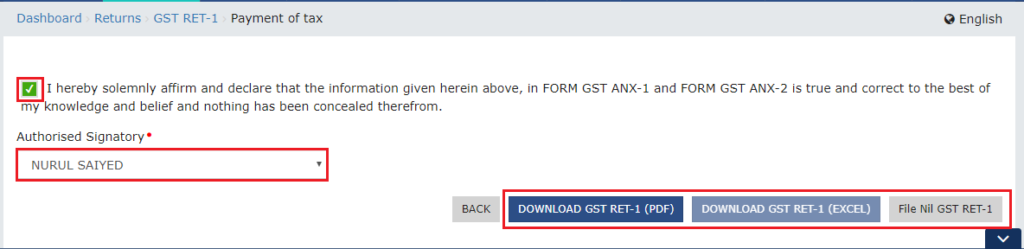

9. Choose the checkbox against the declaration. Choose the Authorized Signatory from the drop-down menu and click File Nil GST RET-1.

Note: You can click the DOWNLOAD GST RET-1 (PDF)/DOWNLOAD GST RET-1 (EXCEL) button to download the GST RET-1 summary form in PDF or Excel format.

10. Click either the FILE WITH DSC or the FILE WITH EVC button.

11. A success message will be displayed and the ARN will be displayed. Status of Form GST RET-1 is changed to “Filed.”

5 (b). File Form GST RET-1

6. From the RET-1 Dashboard, select the appropriate table from the ‘Select Table to Add Details’ drop-down list to view the auto draft liabilities, the Form GST ANX-1/2 Input Tax Credit and add additional details.

Viewing and Adding Details in Tables

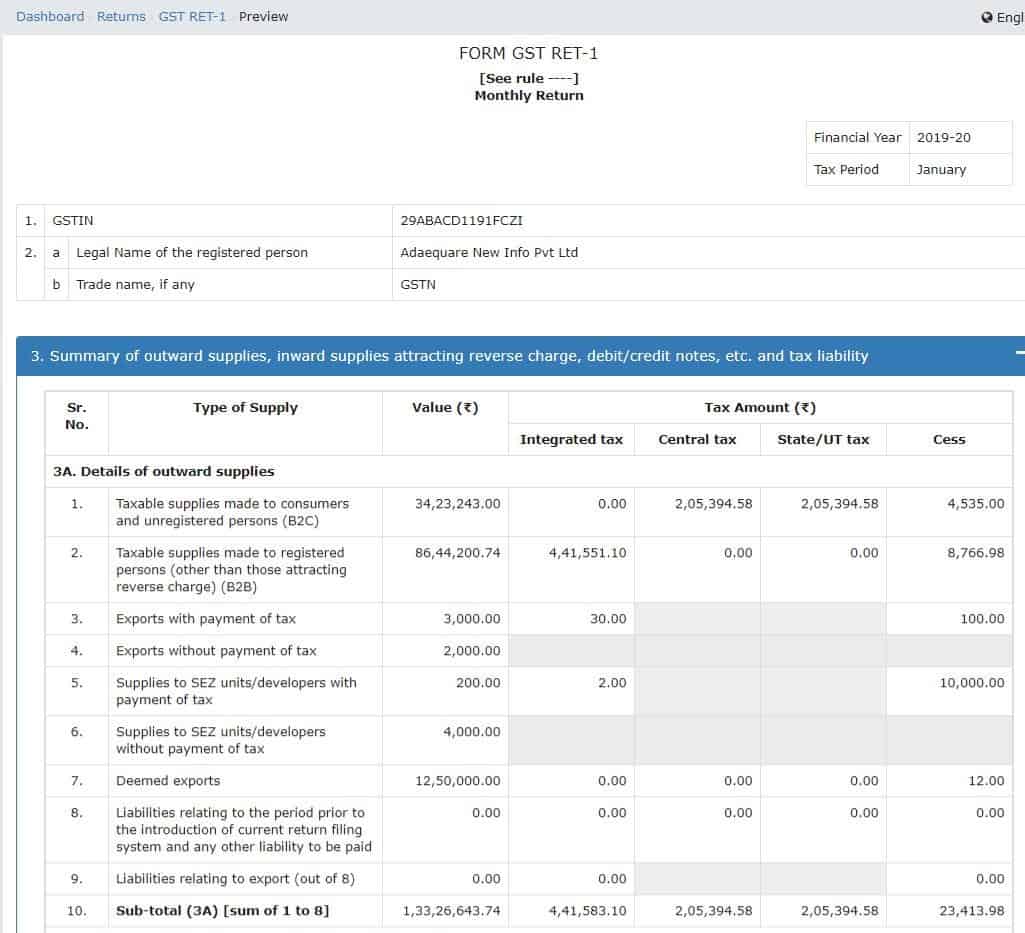

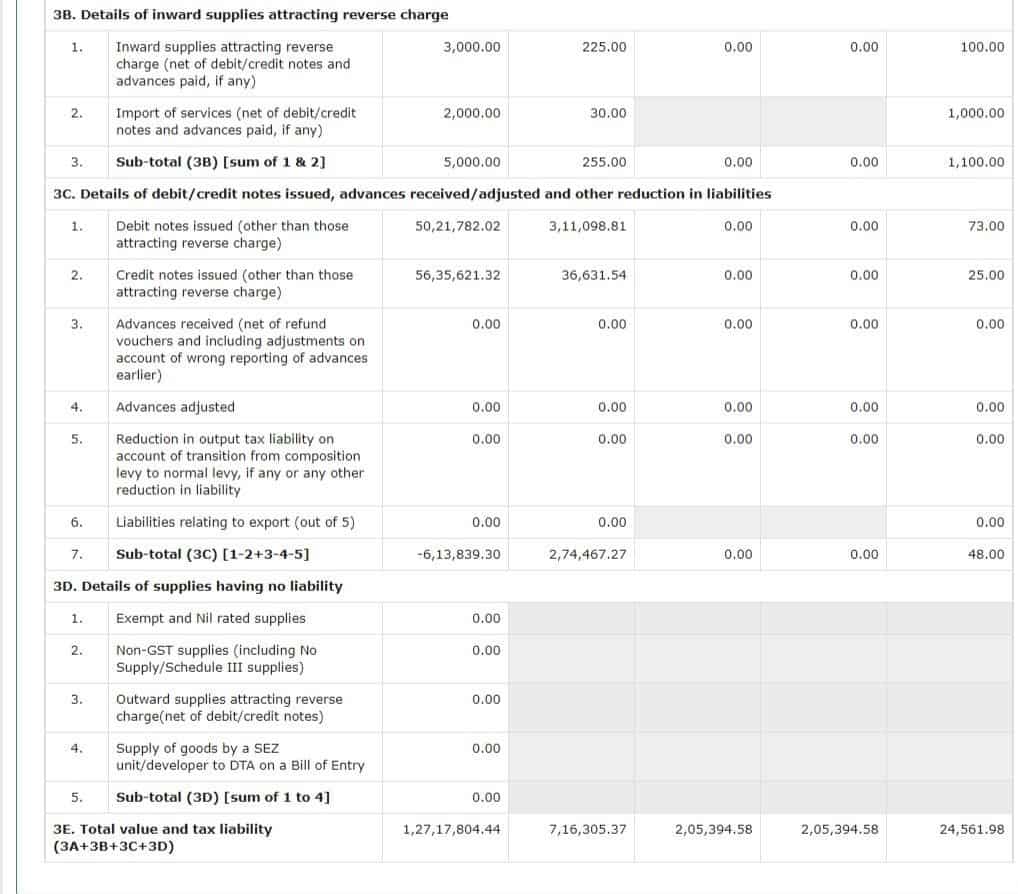

A. Table 3 – Summary of supplies and tax liability

B. Table 4 – Summary of inward supplies for claiming input tax credit

C. Table 6 – Interest and late fee liability details

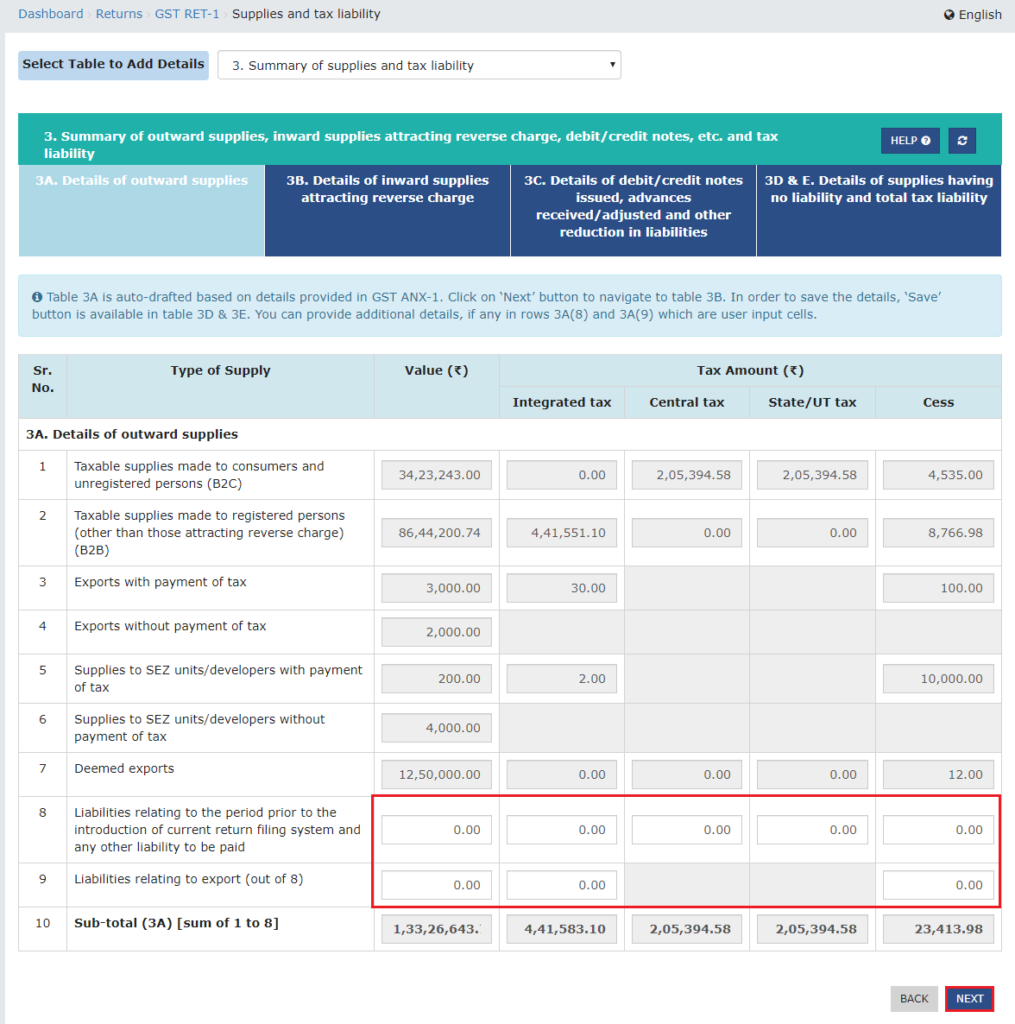

A. Table 3 – Summary of supplies and tax liability

Note:

- All the cells which are in grey colour are system computed values and can’t be edited.

- Save button is available on Table 3D & E to save the details of Table 3.

7. Table 3A is auto-drafted based on details provided in Form GST ANX-1. Enter the additional details and click the NEXT button to navigate to table 3B.

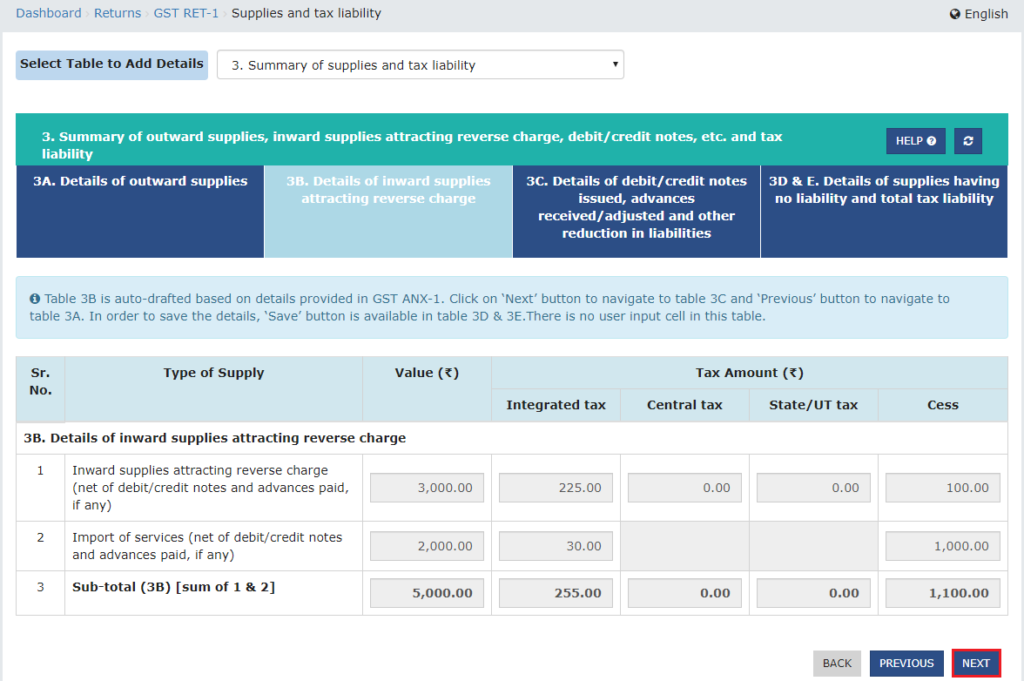

8. Table 3B is auto-drafted based on details provided in Form GST ANX-1. Click the NEXT button to navigate to table 3C.

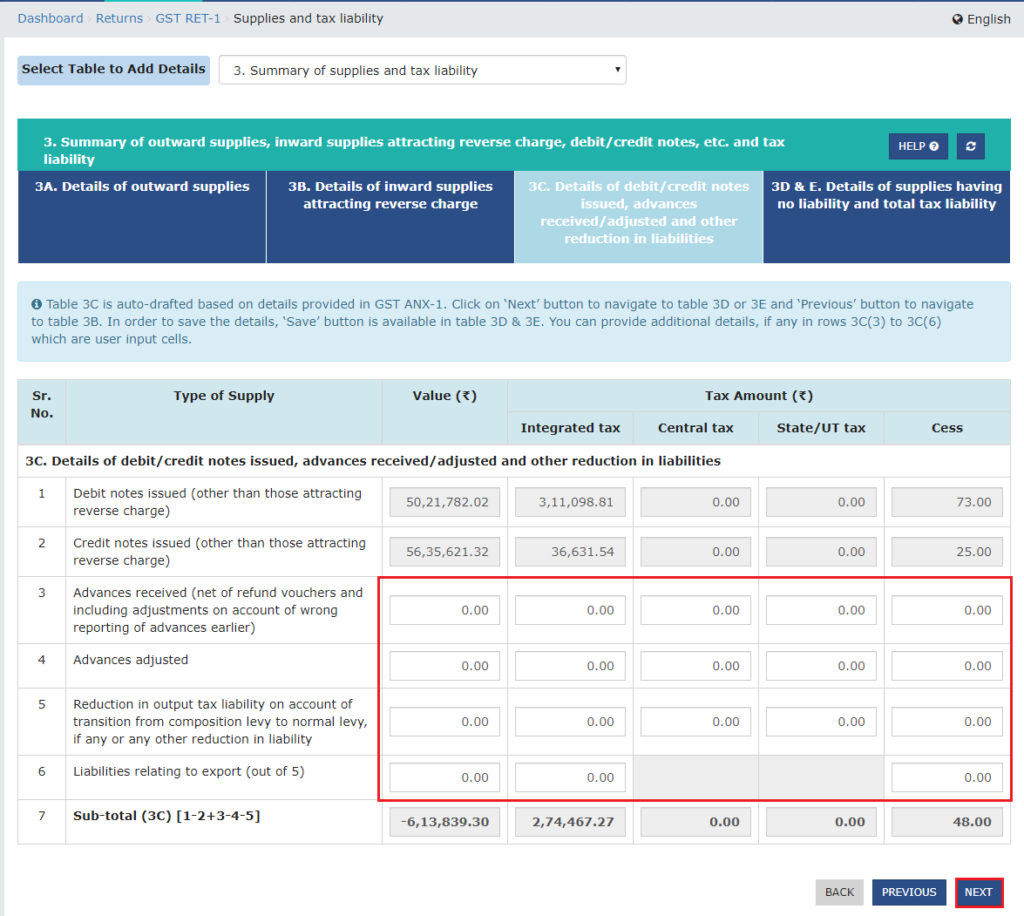

9. Based on the information given in Form GST ANX-1, Table 3C is auto-drafted. To navigate to Table 3D & E, enter the additional information and press the NEXT button.

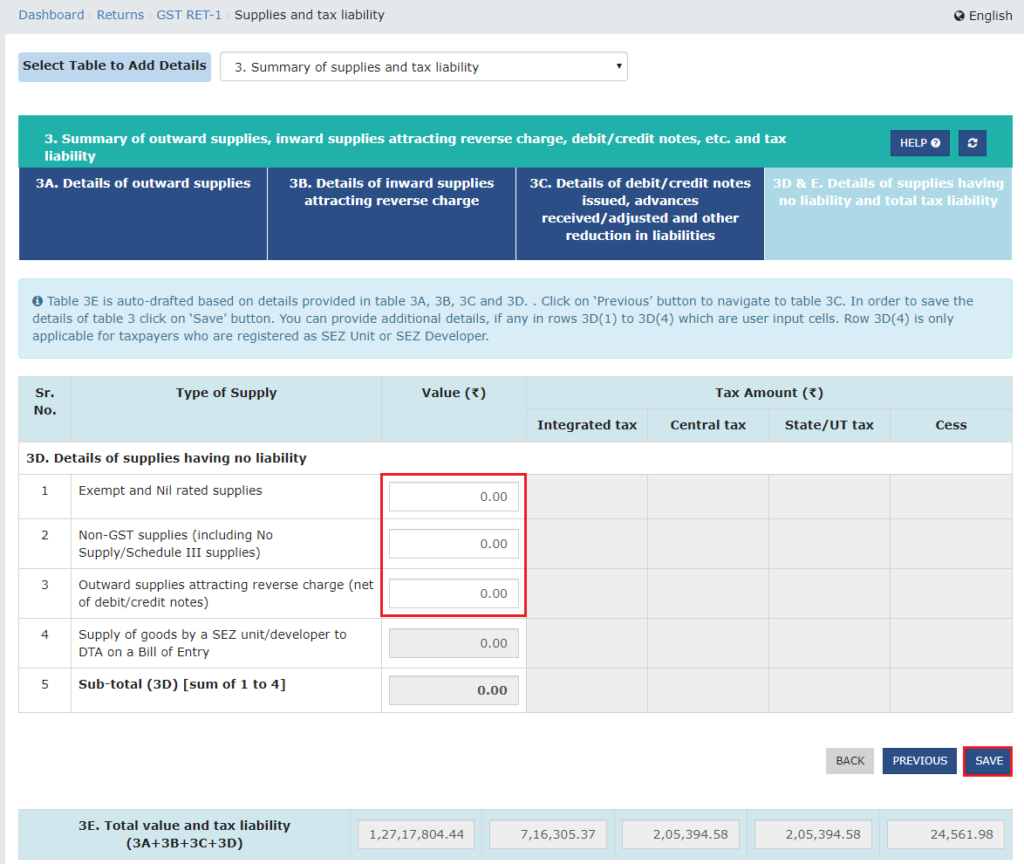

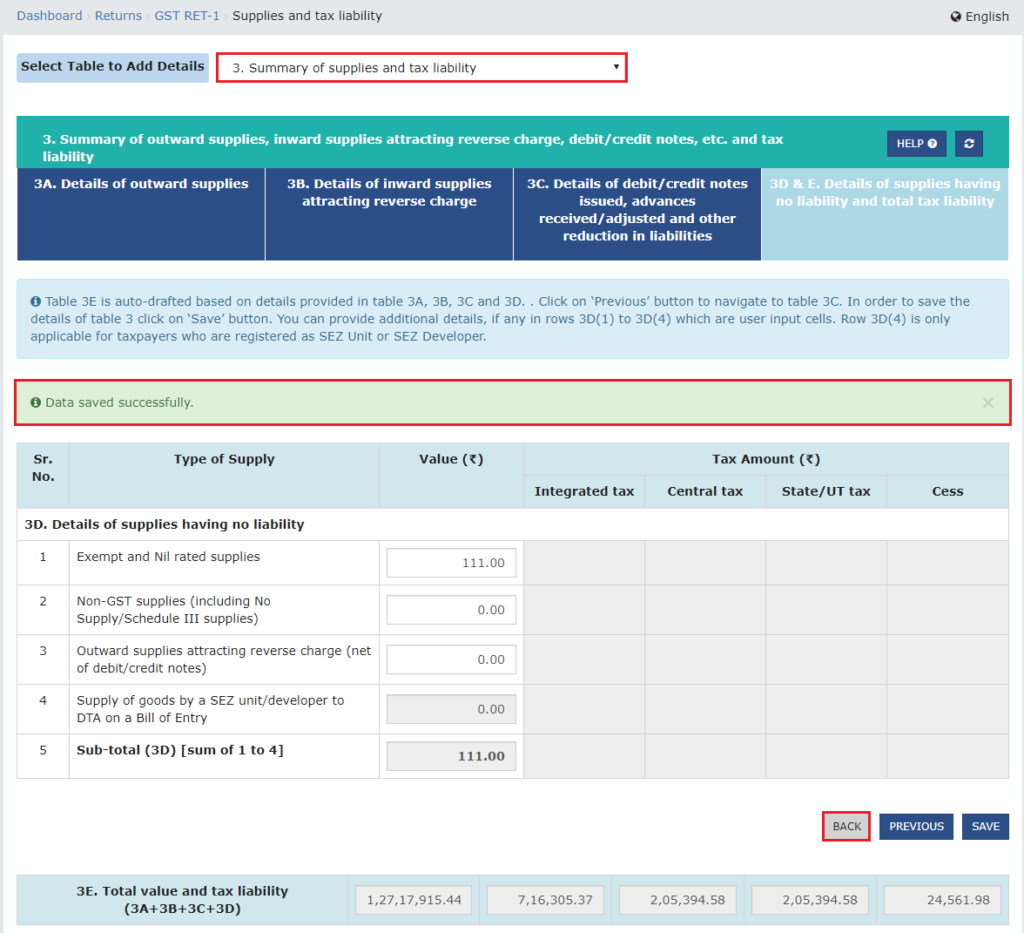

10. Based on the information given in Tables 3A, 3B, 3C and 3D, Table 3E is auto-drafted. To save the data in Table 3, enter the additional details and press the SAVE button.

Note: Row 3D(4) refers only to taxpayers registered as either the SEZ Unit or the SEZ Developer.

11. A confirmation message that data has been successfully saved is shown. Once the details have been saved, move back to the RET-1 Dashboard to choose another table to add details from the drop-down column. Or, from the drop-down list available at the top of table 3, you can click the next table.

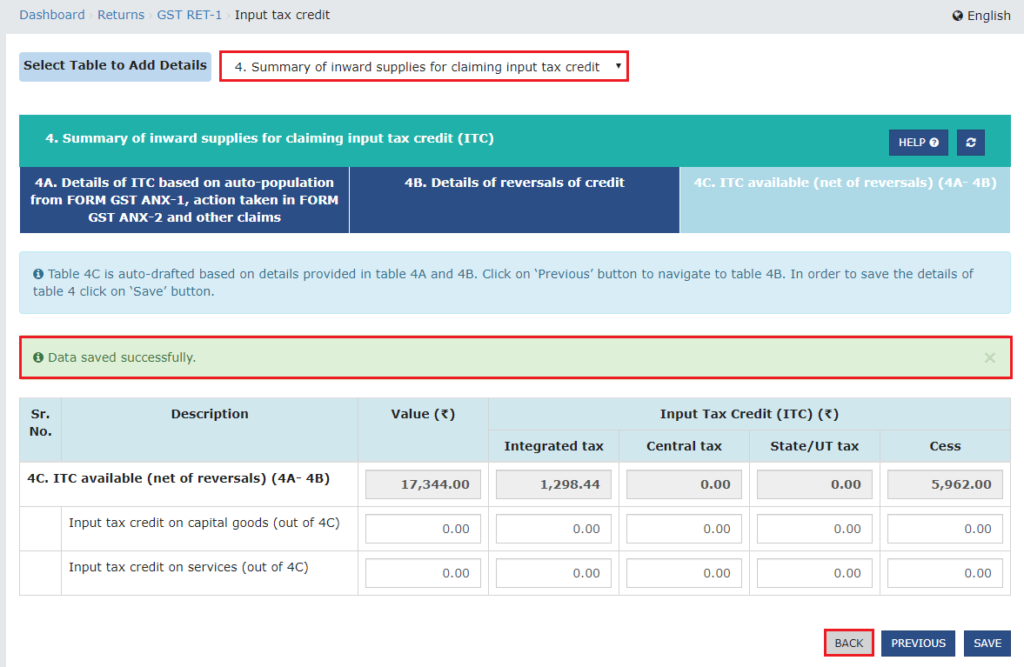

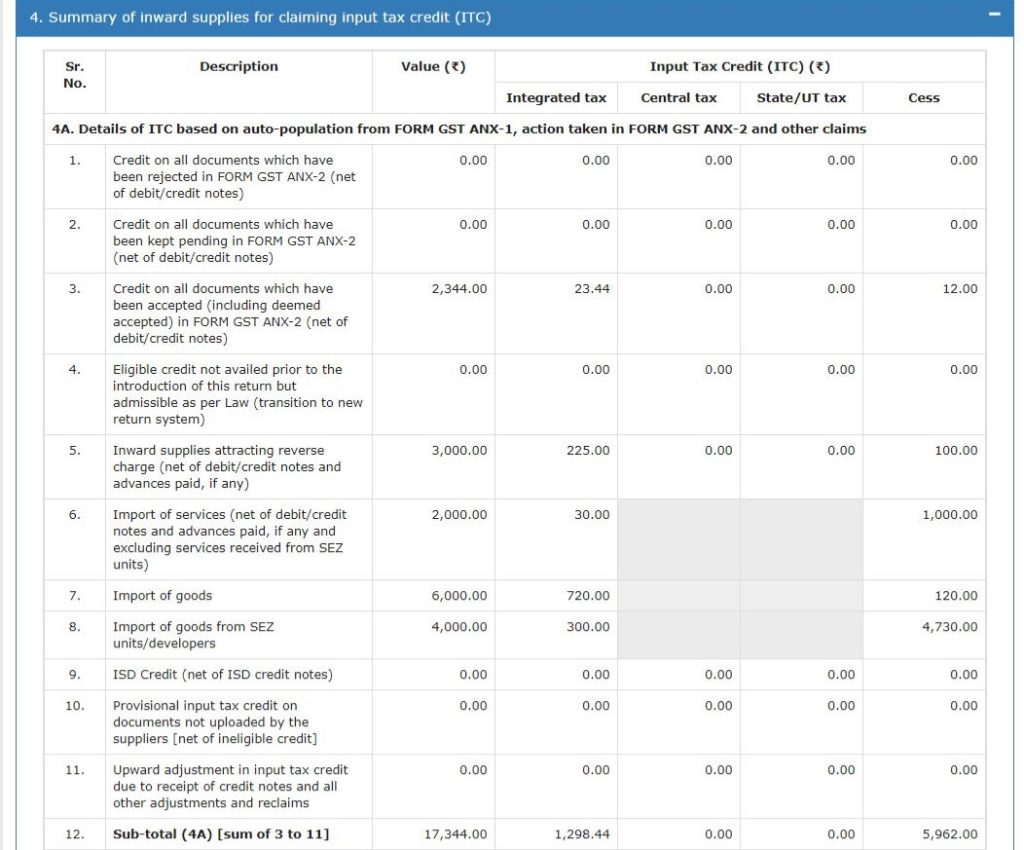

B. Table 4 – Summary of inward supplies for claiming input tax credit

Note:

- The cells in grey colour are computed values of the system and are non-editable.

- On Table 4C, the Save button is available to save the info of Table 4.

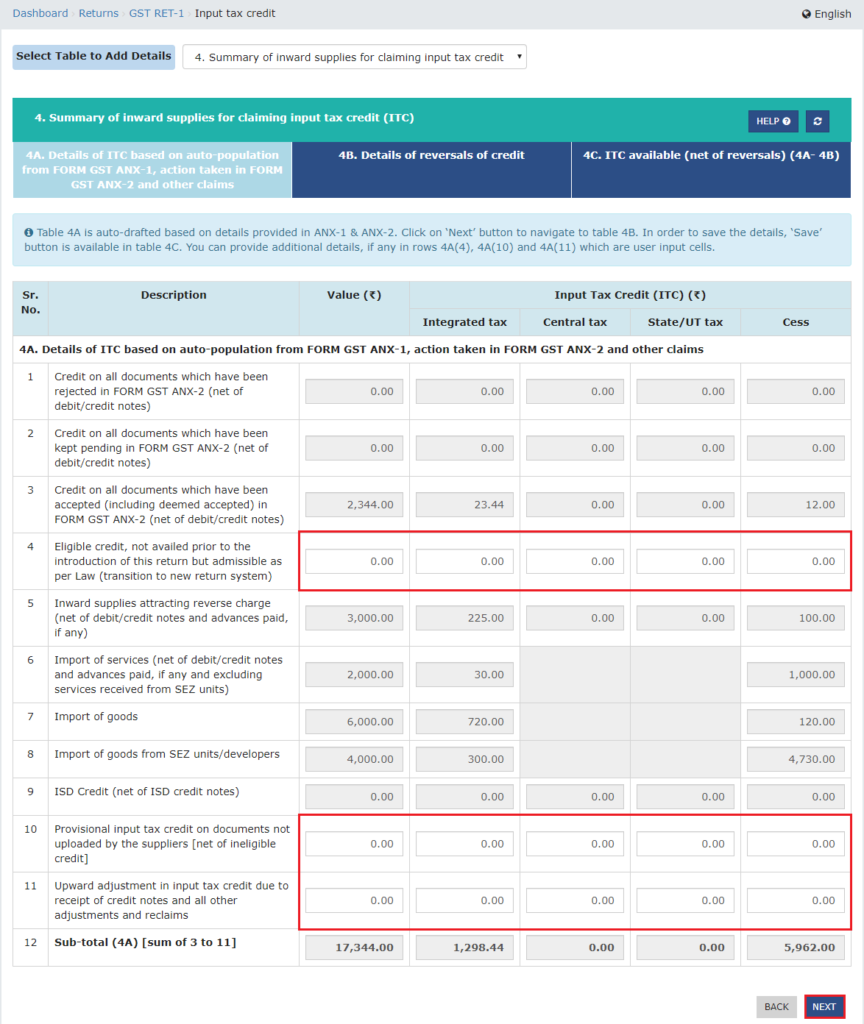

12. Based on details provided in GST ANX-1 & ANX-2, Table 4A is auto-drafted. Enter the additional information, and to navigate to table 4B, press the NEXT button.

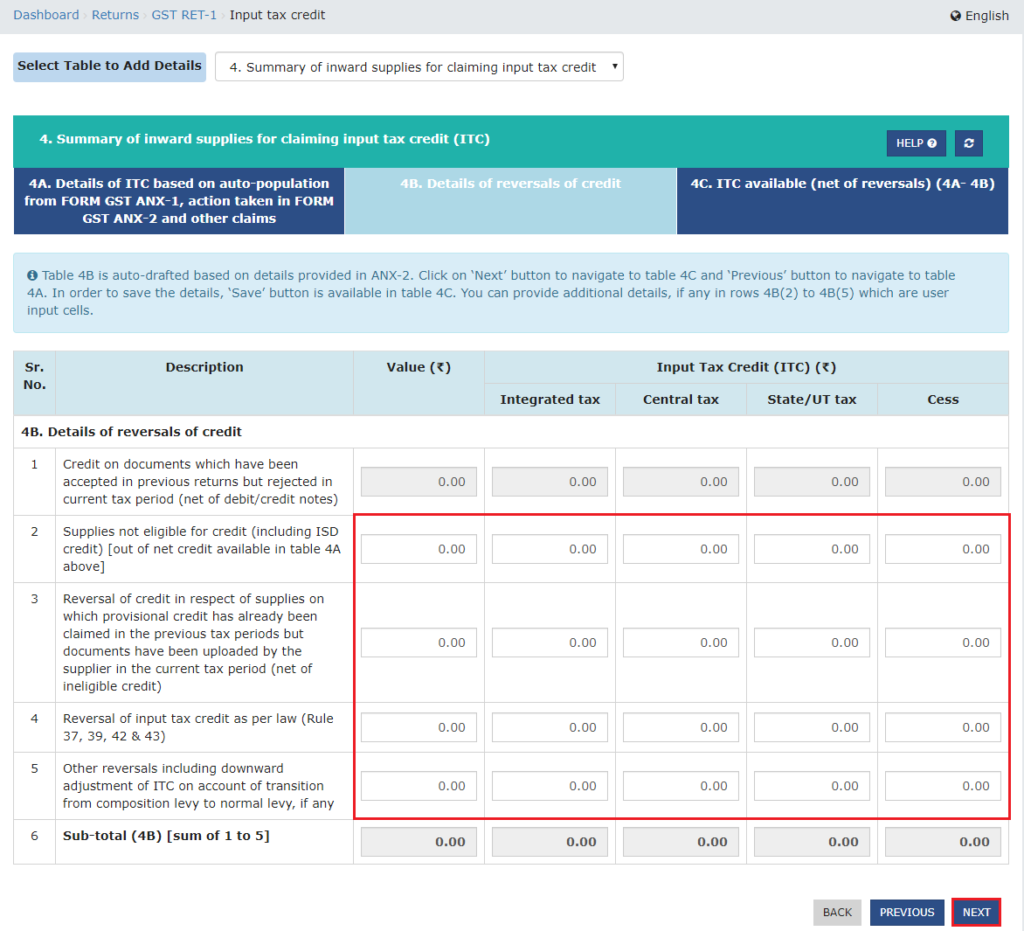

13. Based on details provided in GST ANX-1 & ANX-2, Table 4B is auto-drafted. Enter the additional details, and to navigate to table 4C, click the NEXT button.

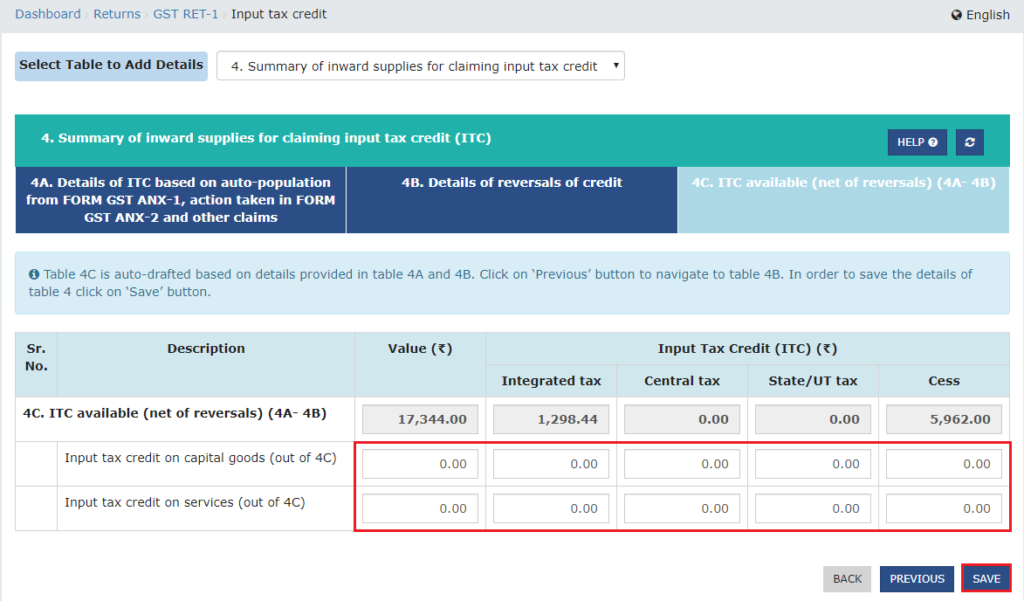

14. Based on the details given in Tables 4A and 4B, Table 4C is auto-drawn. To save the details in Table 4, enter the additional details and click the SAVE button .

15. A confirmation message that data has been successfully saved is displayed. Once the details have been saved, navigate back to the RET-1 Dashboard to select another table to add details from the drop-down list. Or, you can select the next table from the available drop-down list at the top of table 4.

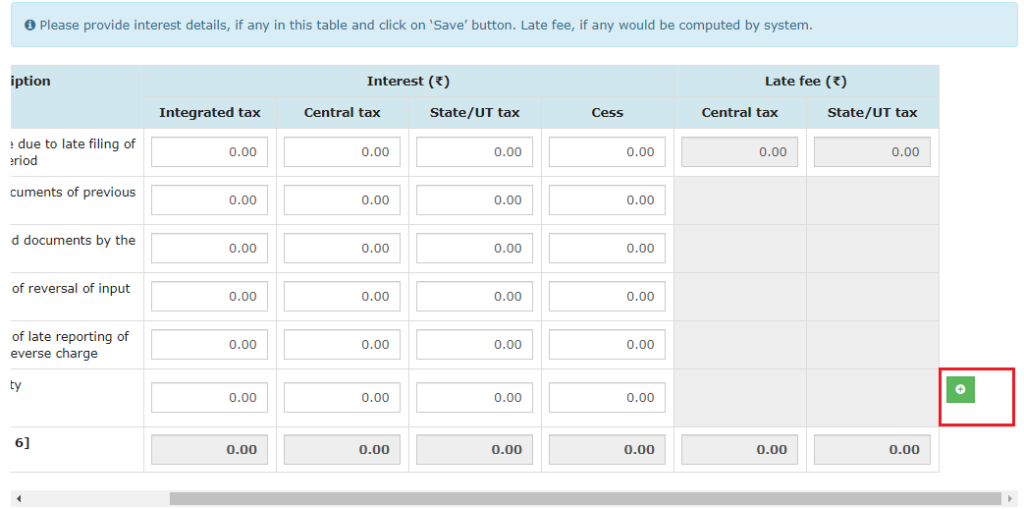

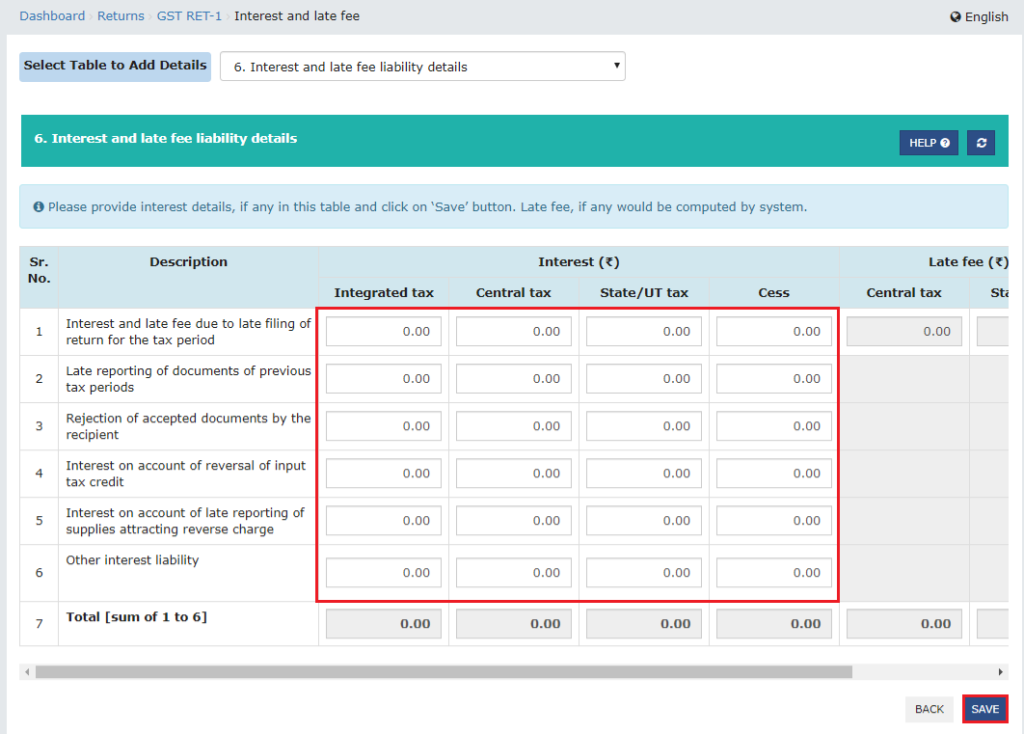

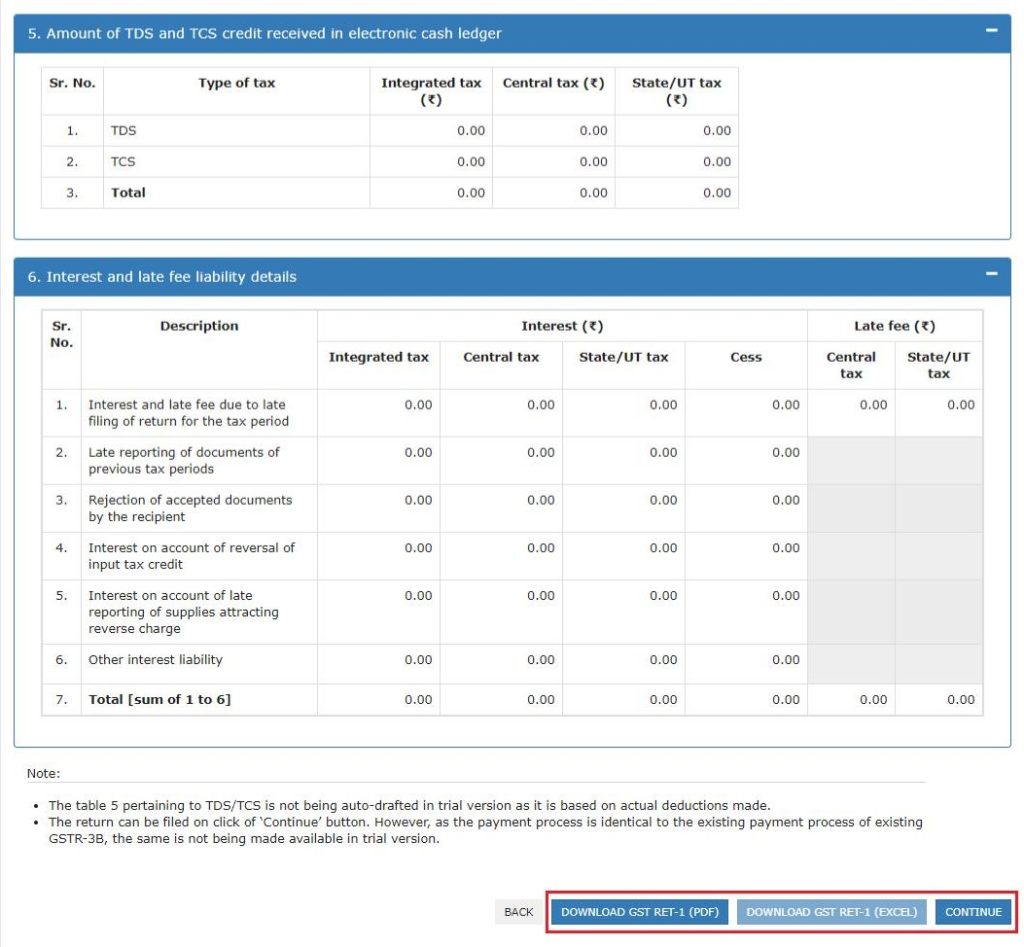

C. Table 6 – Interest and late fee liability details

16. Enter details of interest, where applicable. To provide details of any other interest liability, click the Add (+) icon to add additional line items.

Note:

- To delete any row, click on minus “-“ button.

- Maximum of 5 rows can be added.

17. Click on the SAVE button to save the details in Table 6.

18. A confirmation message that data has been successfully saved is displayed. Click BACK once the details have been saved to navigate back to the RET-1 Dashboard.

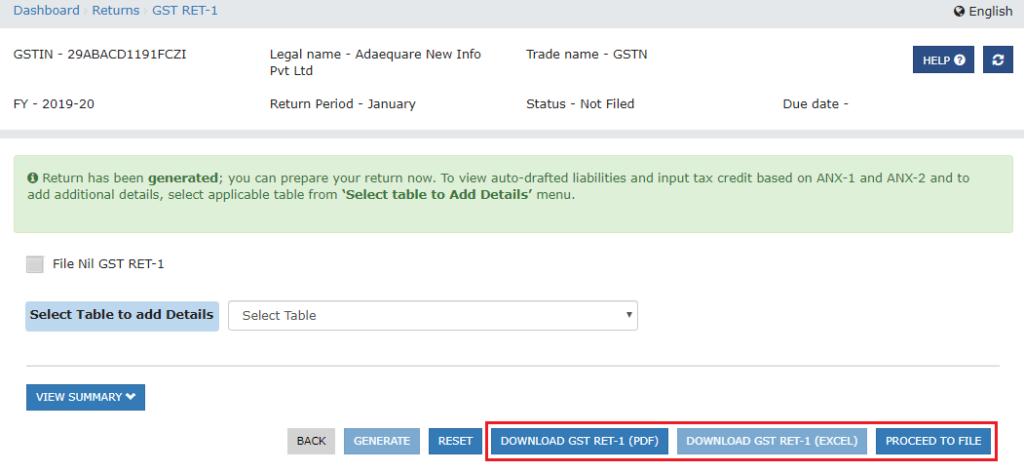

19. To download the Form GST RET-1 summary in PDF or Excel format, click the DOWNLOAD GST RET-1 (PDF)/DOWNLOAD GST RET-1 (EXCEL) button.

Note:

- Click the VIEW SUMMARY button to view the summary of the Total Liabilities and ITCs claimed during the period.

- If some changes are made to Form GST ANX-1 and/or ANX-2 to re-generate the return, click the GENERATE button.

- To reset user entry details provided in all tables, click the RESET button.

20. Click the PROCEED TO FILE button.

21. RET-1 previews are displayed. To download the Form GST RET-1 summary in PDF or Excel format, you can click the DOWNLOAD GST RET-1 (PDF)/DOWNLOAD GST RET-1 (EXCEL) button. Click the button to CONTINUE.

Note:

- In the trial version, table 5 relating to TDS / TCS is not auto-drafted because it is based on actual deductions made.

- You can file a return by clicking the ‘Continue’ button. However, since the payment process is identical to the existing GSTR-3B payment process, the same payment process is not available in the trial version.

22. The Payment of Tax page is displayed.

23. Cash ledger and credit ledger balance available as shown on the date in the “Ledger Balance” table to the taxpayer..

24 (a). Scenario 1: If the Electronic Cash Ledger cash balance is available, it is less than the amount required to offset liabilities

i. If the available cash balance in Electronic Cash Ledger is less than the amount required to offset the liabilities, the additional cash required to be paid by the taxpayer is shown in the “Additional Cash Required” column. You can create an additional cash voucher directly by clicking the CREATE CHALLAN button.

ii. The Create Challan page is displayed.

Note: In the Tax Liability Details grid, the Total Challan Amount field and the Total Challan Amount (In Words) fields are auto-populated with the total amount of payment to be made. You can’t change that amount.

iii. Select the Payment Modes as E-Payment/ Over the Counter/ NEFT/RTGS.

iv. Click the GENERATE CHALLAN button.

v. The Challan is generated.

Note:

In case of Net Banking: You will be directed to the Net Banking page of the selected Bank. The payment amount is shown at the Bank’s website. In the event of a successful payment, you will be redirected to the GST Portal where the transaction status will be displayed.

In case of Over the Counter:

Take a print out of the Challan and visit the selected Bank. Pay using Cash/ Cheque/ Demand Draft within the Challan’s validity period. Status of the payment will be updated on the GST Portal after confirmation from the Bank.

In case of NEFT/ RTGS:

Take a print out of the Challan and visit the selected Bank. Mandate form will be generated simultaneously. Pay using Cheque or through your account with the selected Bank/ Branch. You can also pay using the account debit facility. The transaction will be processed by the Bank and RBI shall confirm the same within <2 hours>. Status of the payment will be updated on the GST Portal after confirmation from the Bank.

24 (b). Scenario 2: If available cash balance in Electronic cash ledger is more than the amount required to offset the liabilities

i. If available cash balance in Electronic Cash Ledger is more than the amount required to offset the liabilities, no additional cash is required for paying liability. You can preview and then file Form RET-1, as explained in below steps.

25. You can click the DOWNLOAD GST RET-1 (PDF)/ DOWNLOAD GST RET-1 (EXCEL) button to download the Form GST RET-1 summary in PDF or the Excel format.

26. Select the Declaration checkbox and select the Authorized Signatory from the drop-down list.

27. Click the FILE GST RET-1 button.

Note: Form GST RET-1 once filed, cannot be revised.

28. The Submit Application page is displayed. Click the FILE WITH DSC or FILE WITH EVC button.

29. The success message is displayed and ARN is displayed. Status of the Form RET-1 return changes to “Filed”.

Note: After Form GST RET-1 is filed:

- ARN will be generated on successful filing of the Form.

- Status of GST RET-1 will be changed to ‘Filed’ from ‘Not filed’.

- An SMS and e-mail will be sent to the taxpayer on the successful filing of Form GST RET-1.

- Electronic Cash Ledger, Electronic Credit ledger and Electronic Liability Register Part-I will get updated after filing of Form RET-1.

source https://www.gst.gov.in/

Disclaimer – Author has exercised utmost care while writing this article, but still this article may contain some error or mistake and no part of this article/writing should be construed or considered as any advice or consultancy whether professional or otherwise. The contents of this article are solely for information and knowledge.

Read Our Other Blogs Also

GST State Code List

Here we are providing the details of the GST state code list of India. The GST state code is mentioned on the GSTIN. A GSTIN or Goods and Services Tax Identification Number is a PAN-based 15-digit alphanumeric unique identification number. GSTIN is provided to every…

How to File GSTR 3B Nil Return by SMS

In a significant move towards taxpayer facilitation, the Government has today onwards allowed to File GSTR 3B NIl Return By SMS in GSTR-3B FORM. This would significantly improve the ease of GST compliance for more than 22 lakh registered taxpayers who would otherwise have to…

What is GSTIN and Format of GSTIN ? (15 Digit Number)

What is GSTIN Number? GSTIN stand for Goods and Service Tax Identification Number. A GSTIN is a PAN-based 15-digit unique identification number. It is allocated to every GST-registered person. This unique number is issued according to state wise. Format of gSTIN ? Format or structure…

Continue Reading What is GSTIN and Format of GSTIN ? (15 Digit Number)

GST Invoice Format in Excel | Word | PDF India

GST Invoice is a business instrument issued by a supplier or a seller to the recipient or the buyer of the goods and services. In other words, The GST invoice Format includes a list of goods or services provided, along with many others details included…

Continue Reading GST Invoice Format in Excel | Word | PDF India

Contact Us

If any queries/doubt, feel free to contact us at adacom26@gmail.com

You may refer our channel on Youtube also:CA ADAgarwal

Kindly “Subscribe” our channel on YouTube for regular updates on Income Tax & GST.

About the Author:

Ankit is a Chartered Accountant based in Delhi and the founder of ADA & Co. He has over 7 years of work experience, specializing in the field of taxation (Direct & Indirect) practice. He also has knowledge in the full range of financial services including Business, Taxation, Audit and Account. Further, he has managed assignments in respect of GST Audits, Bank Audits, Stock Audits, PSUs Audits, AR & AP Reconciliation etc and represented clients in tax litigative matters before Indian tax authorities. The aim of this article is to enable the professionals in the industry and students & businessmen to be aware with current developments in the Direct and Indirect tax laws and Accounting Practices.